GEICO and State Farm offer the cheapest car insurance for new drivers in 2026, averaging $2,400-$2,800 annually for full coverage compared to $3,500+ at other major insurers. Finding the best cheap car insurance for new drivers means understanding that you’ll pay $200-$350 monthly regardless of carrier, but these two consistently beat competitors by 15-25% when you stack discounts properly. This guide is for student drivers, recent license holders, and parents adding teen drivers who need real coverage at the lowest possible cost—not experienced drivers shopping for standard rates.

If you’re over 25 with a clean record, you don’t face the “new driver penalty” that makes insurance brutally expensive.

Why New Driver Insurance Costs So Much (And What Actually Lowers It)

Insurance companies charge new drivers 2-3x more than experienced drivers because the statistics are brutal: drivers under 25 cause accidents at nearly double the rate of drivers over 25, according to Insurance Institute for Highway Safety research. You’re mathematically riskier to insure, and no amount of negotiation changes that reality.

The key is minimizing how much extra you pay through strategic choices most new drivers miss.

Your car choice matters more than your carrier. Insuring a 2018 Honda Civic costs roughly $2,200 annually for a new driver. That same driver in a 2018 Dodge Charger pays $3,800+ because muscle cars correlate with higher claim rates and repair costs. Insurers price this into premiums before you even request a quote.

Safe, common vehicles with good crash ratings and low theft rates get the best rates: Honda Civic, Toyota Corolla, Mazda3, Subaru Impreza, Honda CR-V. Avoid anything turbocharged, rear-wheel-drive sports models, or luxury brands if you’re trying to minimize insurance costs. For detailed guidance on choosing an affordable first car, check our complete first-time car buyer guide.

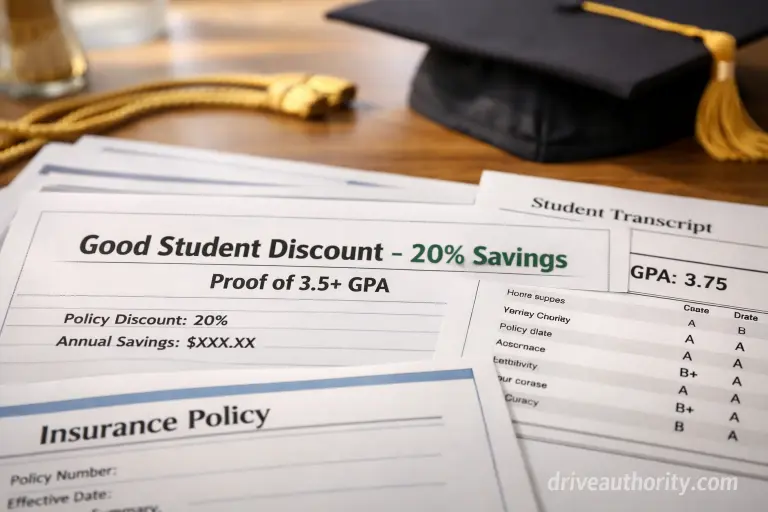

Good student discounts are real money. Maintaining a 3.0 GPA or better saves 15-25% with most carriers—that’s $360-$700 annually. GEICO, State Farm, and Progressive all offer this discount and actually verify it through report cards or transcripts.

Defensive driving courses cut rates by 5-10%. Many states mandate insurers offer discounts for completing approved driving courses. These cost $25-$50 and take 4-6 hours online. The discount saves $120-$280 yearly and often lasts 3+ years. It’s the highest ROI move a new driver can make.

Best Cheap Car Insurance Companies for New Drivers Compared

GEICO consistently offers the lowest rates for new drivers nationally, averaging $2,420 annually for full coverage. Their quote process is genuinely fast (10-15 minutes online), and their mobile app for filing claims works well. Customer service is hit-or-miss—you’re calling a national center, not a local agent.

State Farm averages $2,680 annually but has local agents, which matters when you need to actually file a claim or adjust coverage. For parents adding teen drivers to existing State Farm policies, this is often $400-$600 cheaper than having the teen get separate coverage. Their Drive Safe & Save app offers usage-based discounts up to 30% if you drive safely.

Progressive runs $2,850-$3,100 annually but their Snapshot program (monitoring your actual driving) can reduce that by 20-30% if you avoid hard braking and late-night driving. This works well for genuinely careful new drivers but penalizes you if you drive like a typical teenager.

Allstate and Nationwide charge $3,200-$3,600 for new drivers—about 25-35% more than GEICO for identical coverage. Skip these unless you’re bundling with parents’ existing policies for multi-car discounts.

USAA beats everyone at $1,980-$2,300 annually, but you must be military-affiliated (service member, veteran, or their dependent). If you qualify, this is unbeatable.

Real example: My neighbor’s 19-year-old son got quotes ranging from $2,340 (GEICO) to $3,720 (Allstate) for the same 2020 Mazda3 with identical coverage limits. He went with GEICO plus the good student discount and pays $197/month instead of $310.

Coverage Levels New Drivers Actually Need

Most new drivers buy whatever their state minimum requires—a huge mistake that costs them thousands after even a minor accident.

State minimums are dangerously low. Many states only require $25,000 bodily injury coverage per person, according to state insurance requirements. One emergency room visit after an accident easily exceeds this, leaving you personally liable for the difference. If you cause $75,000 in injuries with minimum coverage, you’re on the hook for $50,000 out of pocket.

Recommended minimums for new drivers:

- Bodily injury: $100,000 per person / $300,000 per accident

- Property damage: $100,000

- Uninsured motorist: Match your bodily injury limits

- Comprehensive/collision: If your car is worth over $5,000

This coverage costs about 30-40% more than state minimums but protects you from financial catastrophe. You’re already paying $200-$300 monthly—spending an extra $60-$80 for adequate protection makes sense.

Skip collision/comprehensive if you’re driving a car worth under $3,000. The deductibles and premiums combined often exceed the car’s value within 2-3 years.

Money-Saving Strategies for Cheap New Driver Insurance

Stay on parents’ policy if possible. Adding a teen to parents’ existing policy costs $1,200-$1,800 annually. That same teen getting their own policy pays $2,800-$4,200 annually. The savings are massive—roughly $1,400-$2,400 yearly just from staying on the family plan.

Pay every 6 months instead of monthly. Insurers charge 5-10% more for monthly payment plans versus paying the full 6-month premium upfront. If you can swing $1,200 every six months instead of $220 monthly, you’ll save $120-$240 annually.

Increase your deductible strategically. Raising your collision deductible from $500 to $1,000 typically cuts premiums by 10-15%. Only do this if you can actually afford the $1,000 out-of-pocket if you have an accident. Don’t set a $2,000 deductible you can’t pay just to lower monthly costs.

Bundle renters insurance. If you’re renting an apartment or dorm, adding renters insurance ($10-$20 monthly) to your auto policy often triggers multi-policy discounts that save $100-$200 annually on your car insurance—more than the renters policy costs.

Shop annually, but not obsessively. Insurance rates change yearly. Get fresh quotes from 3-4 carriers each renewal period. However, switching carriers every 6 months for $40 savings isn’t worth the hassle and can actually raise rates since carriers reward loyalty with tenure discounts.

For more comprehensive guidance on managing car ownership costs as a new driver, see our complete guide to first-time car ownership expenses.

| Pros | Cons |

|---|---|

| GEICO and State Farm 15-25% cheaper than competitors | New drivers still pay $2,400-$3,500 annually minimum |

| Good student discounts save $360-$700/year | Rates stay high until age 25 regardless of clean record |

| Defensive driving courses are cheap, high-ROI | Usage-based monitoring programs invade privacy |

| Staying on parents’ policy saves $1,400-$2,400/year | State minimums dangerously inadequate for new drivers |

| Local agents (State Farm) help with claims | National call centers (GEICO) frustrating for complex issues |

Your Next Step for Best Cheap Car Insurance for New Drivers

Get quotes from GEICO, State Farm, and Progressive with identical coverage levels: 100/300/100 liability, $500-$1,000 deductibles, and uninsured motorist coverage matching your liability limits. Provide proof of good grades if applicable and ask specifically about defensive driving course discounts.

If you’re under your parents’ roof, get quotes for being added to their existing policy versus starting your own. The family plan almost always wins by $1,200+ annually.

Choose the safest, most boring car you can tolerate. A 2019 Honda Civic might feel less exciting than a Mustang, but it’ll save you $1,500+ yearly in insurance—money you can spend on literally anything more enjoyable than insurance premiums.

The best cheap car insurance for new drivers comes down to GEICO or State Farm with every possible discount stacked: good student, defensive driving, multi-car (if applicable), and either paperless billing or automatic payments. Expect to pay $2,200-$2,800 annually for real coverage, and don’t get suckered into inadequate state minimums just to save $50 monthly.

Pingback: Best Cheap Car Insurance for New Drivers in 2026 (Real Costs) - DriveAuthority