What Are the Common Problems With Chinese EVs? A Complete Owner-Based Breakdown

The electric vehicle landscape has shifted dramatically in the last five years. Walk through any dealership in Europe, Southeast Asia, or Latin America, and you’ll see names that barely existed a decade ago: BYD, NIO, MG, Geely, Chery. These Chinese EV manufacturers have flooded global markets with sleek designs, advanced tech, and price tags that undercut established brands by thousands.

On paper, it’s a compelling story. A BYD Atto 3 offers similar range to a Volkswagen ID.4 at 30% less cost. An MG4 rivals the Nissan Leaf while packing more features. For budget-conscious buyers tired of waiting for affordable electric mobility, Chinese EVs seem like the perfect solution.

However, beneath the glossy marketing and impressive spec sheets, a different narrative is emerging from actual owners. Common problems with Chinese EVs are surfacing across markets—from software glitches and service center struggles to unexpected battery performance drops and plummeting resale values. Online forums buzz with real-world complaints that brochures never mention.

Understanding these common problems with Chinese EVs isn’t about dismissing an entire industry—it’s about making an informed decision before you commit to years of ownership. This guide draws from real owner experiences, independent testing data, and industry analysis to reveal what works, what doesn’t, and what you need to know before signing on the dotted line.

Why Chinese EVs Are Under Scrutiny

Chinese automakers have compressed what took Western and Japanese brands decades into just a few years. BYD alone now sells more EVs globally than any manufacturer except Tesla. NIO promises autonomous driving capabilities. Geely owns Volvo and Polestar. These aren’t fringe players—they’re reshaping the entire automotive industry.

Yet this rapid ascent comes with growing pains. Moreover, it raises a fundamental question: can you build long-term reliability without long-term testing?

The scrutiny isn’t about prejudice—it’s about precedent. Every new entrant to the auto market faces skepticism. Hyundai and Kia spent decades shaking off reputations for poor quality. Tesla endured years of panel gap jokes and early production disasters. Chinese EV makers are now in that proving phase, and buyers are learning hard lessons about being early adopters.

Why Chinese EV Problems Differ From Traditional Automakers

To understand the common problems with Chinese EVs, you first need to understand how these vehicles are developed differently from established brands.

Fast Innovation vs Long-Term Testing

Traditional automakers test new models for five to seven years before launch. They run durability tests simulating 10 years of ownership. They validate every component across extreme climates, from Arctic cold to desert heat.

Chinese EV manufacturers operate on compressed timelines—often 18 to 24 months from concept to production. This acceleration enables rapid innovation but creates gaps in long-term validation. When a BYD Seal or MG ZS EV hits showrooms, it may have undergone only two years of real-world testing.

The result? Problems that traditional automakers would catch in validation—thermal management failures, software incompatibilities, premature component wear—emerge in customer hands instead.

Cost Leadership Comes With Trade-Offs

Chinese EV manufacturers leverage vertical integration and economies of scale to undercut competitors. BYD manufactures its own batteries, semiconductors, and electric motors. This control enables aggressive pricing.

However, cost savings come from somewhere. Often, manufacturers economize on:

- Interior material quality (cheaper plastics, thinner fabrics)

- Soundproofing and vibration dampening

- Advanced safety sensor calibration

- Global after-sales infrastructure development

Conversely, they don’t typically skimp on headline features—battery capacity, touchscreen size, and driver assistance systems receive investment because they drive purchasing decisions. This creates vehicles that look impressive on a test drive but reveal compromises over months of ownership.

Battery-Related Problems in Chinese EVs

The battery is the heart of any electric vehicle, and it’s where some of the most significant problems with Chinese EVs manifest.

Real-World Range vs Claimed Range

One of the most frequent owner complaints centers on range discrepancy. A vehicle advertised with 350 kilometers of range might deliver 280 in real-world conditions—a 20% shortfall.

This isn’t unique to Chinese EVs, but the gap tends to be wider. Why? Testing methodology matters. Chinese manufacturers often cite CLTC (China Light-Duty Vehicle Test Cycle) figures, which are notably more optimistic than the WLTP standard used in Europe or EPA testing in the United States.

Furthermore, extreme temperatures exacerbate the problem. Owners in Scandinavia report 40% range drops in winter. Those in the Middle East see thermal management systems draining significant battery capacity to cool cells.

An MG4 owner in Norway shared: “The advertised 450km becomes 270km in January. I planned my commute around the official figure and now face range anxiety every week.”

Battery Degradation Over Time in Chinese EVs

Early data on battery longevity reveals concerning patterns. While manufacturers typically warranty batteries for eight years or 160,000 kilometers, real-world degradation sometimes exceeds expectations.

Some BYD Blade Battery-equipped vehicles have shown minimal degradation—a testament to LFP chemistry. However, older NCM (nickel-cobalt-manganese) cells in models like early MG ZS EVs have degraded faster than competitors, with some owners reporting 15% capacity loss within three years.

Replacement costs compound the issue. A new battery pack can cost €8,000 to €15,000—often exceeding the vehicle’s depreciated value after five years. Moreover, warranty coverage contains exclusions for “abnormal use,” leaving owners in gray areas when degradation occurs.

Charging Compatibility Issues

Chinese EVs often support DC fast charging, but real-world performance varies dramatically. Software throttling, thermal management concerns, and charger compatibility issues create frustration.

For instance, several NIO and Xpeng models limit charging speed when battery temperature exceeds certain thresholds—even in moderate climates. Owners expecting 150kW charging receive 50kW instead, tripling charging time.

Additionally, compatibility with third-party charging networks remains inconsistent. Some vehicles fail to initiate charging sessions with certain CCS chargers, requiring owners to use specific networks—reducing convenience and potentially increasing costs.

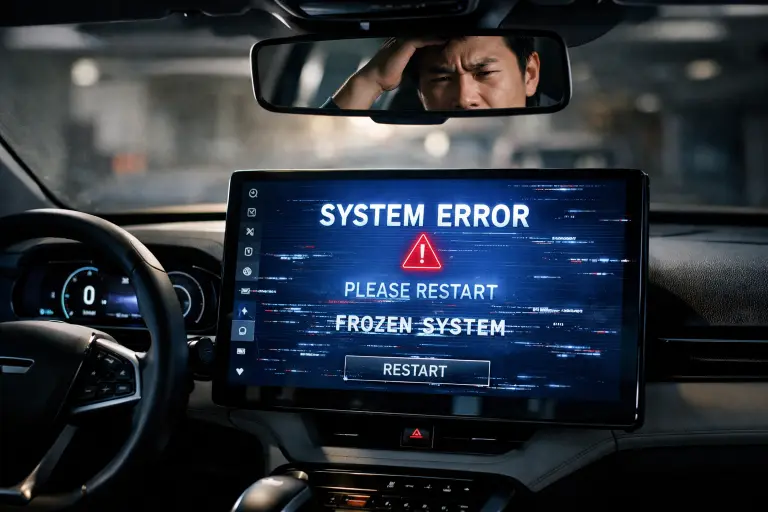

Software & Infotainment Issues With Chinese EVs

If batteries are the heart of an EV, software is the nervous system. Unfortunately, this is where common problems with Chinese EVs become most apparent.

Unstable Operating Systems

Many Chinese EV manufacturers develop proprietary operating systems to differentiate from competitors. NIO runs NOMI, BYD uses DiLink, Xpeng has Xmart OS. These systems promise smartphone-like experiences with over-the-air updates and AI integration.

In practice, owners report frequent glitches:

- Infotainment screens freezing mid-drive

- Navigation systems crashing

- Climate control becoming unresponsive

- Complete system reboots requiring vehicle restart

One Geely Geometry owner described: “Twice in six months, my entire screen went black while driving. No speedometer, no navigation, no climate control. I had to pull over and restart the car.”

Over-the-air updates, touted as a feature, sometimes introduce new problems. Unlike Tesla’s relatively stable update process, Chinese EV manufacturers occasionally push buggy software, forcing owners to visit service centers for rollbacks.

Localization and Language Problems

When Chinese EVs enter foreign markets, software localization often lags behind hardware availability. Buyers in Europe, Southeast Asia, and South America report:

- Awkward or incorrect translations in menus

- Voice assistants that don’t understand local accents or languages

- Navigation systems with outdated maps or missing points of interest

- Error messages appearing in Chinese characters

These aren’t mere annoyances—they affect usability and safety. When a critical warning appears in an unfamiliar language or format, drivers may not respond appropriately.

Transition: While hardware quality has improved remarkably in recent models, software remains a persistent weak link—one that can’t be fixed with better materials or tighter assembly tolerances.

Build Quality and Interior Durability Issues

Step inside a new Chinese EV at a showroom, and you’ll often find impressive design—large screens, ambient lighting, sleek surfaces. However, long-term owners tell a different story about how these interiors age.

Material Wear Over Time

Cost-cutting in interior materials becomes evident after months of use. Common complaints include:

- Seat fabric pilling or wearing through within the first year

- Dashboard plastics cracking or warping in heat

- Door trim pieces becoming loose or rattling

- Piano black surfaces scratching easily

An MG ZS EV owner in Australia noted: “After 18 months, the driver’s seat looks like it’s five years old. The fabric has worn thin where I get in and out, something I never experienced with my previous Honda.”

The contrast with established brands is stark. A comparable Volkswagen or Toyota might use slightly less flashy materials, but they’re engineered for durability. Chinese EVs often prioritize showroom appeal over long-term resilience.

Assembly Consistency Problems

Quality control varies significantly—not just between brands, but between individual vehicles from the same production line. This inconsistency stems from rapid scaling and less mature manufacturing processes.

Owners report:

- Uneven panel gaps

- Misaligned trim pieces

- Wind noise from improperly sealed doors

- Squeaks and rattles over rough roads

Moreover, early production batches tend to have more issues. A vehicle from the first six months of a model’s launch often has problems that get resolved in later production runs. This creates a lottery for early adopters.

Safety and Driver Assistance Limitations in Chinese EVs

Modern Chinese EVs pack impressive driver assistance features—adaptive cruise control, lane keeping assist, automatic emergency braking. On paper, they rival premium brands. In practice, calibration and reliability issues create safety concerns.

ADAS Calibration Issues

Advanced Driver Assistance Systems (ADAS) require precise calibration and extensive real-world validation. When rushed to market, these systems behave unpredictably.

Common complaints about Chinese EV driver assistance include:

- Over-sensitive lane keeping: Systems that ping-pong between lane markings or fight driver inputs

- Phantom braking: Automatic emergency braking activating for non-existent obstacles like shadows, overhead signs, or oncoming traffic in adjacent lanes

- Poor low-light performance: Cameras and sensors struggling in rain, fog, or darkness

- Inconsistent adaptive cruise control: Systems that brake too hard or accelerate too aggressively

A BYD Tang owner in the UK shared: “The lane assist is so aggressive I’ve disabled it completely. It would jerk the wheel without warning, which felt more dangerous than not having it at all.”

These aren’t minor inconveniences—they erode trust in safety systems and can create hazardous situations.

Crash Test Transparency Concerns

Safety ratings vary dramatically depending on testing organization and market. A Chinese EV might receive a five-star C-NCAP rating in China but perform worse in Euro NCAP testing, which uses stricter protocols.

Furthermore, independent crash test data remains limited for many models. Buyers in emerging markets often lack any local crash test results, relying instead on manufacturer claims or Chinese domestic ratings that may not reflect their market’s vehicle specification.

This opacity makes it difficult to compare safety objectively against established brands with decades of transparent crash test history.

Reliability and Mechanical Problems

Electric vehicles have fewer moving parts than combustion engines, which theoretically improves reliability. However, mechanical problems still plague some Chinese EVs.

Suspension and Chassis Wear Issues

Several models show premature suspension component failure—bushings wearing out, shock absorbers leaking, or control arm joints developing play within the first 50,000 kilometers.

This stems partly from optimizing for smooth test drives rather than long-term durability. A suspension tuned for comfortable city driving may not withstand years of potholed roads or aggressive driving.

Owners report:

- Clunking noises over bumps appearing within the first year

- Uneven tire wear indicating alignment issues

- Squeaking or creaking from suspension components

These mechanical issues require warranty repairs but create inconvenience and erode confidence in vehicle longevity.

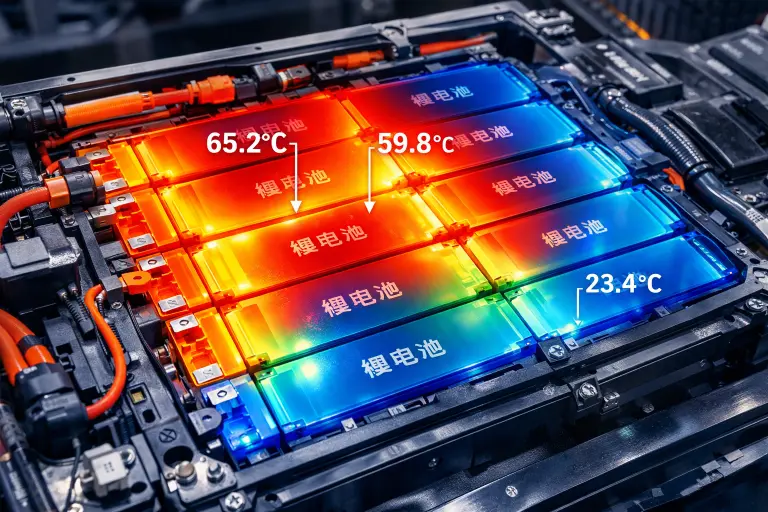

Thermal Management Problems in Chinese EVs

Effective thermal management is critical for EV performance, longevity, and safety. Chinese manufacturers have made significant progress, particularly BYD with its Blade Battery cooling systems, but problems persist in some models.

Issues include:

- Battery overheating: Reduced performance or complete charging shutdown during hot weather

- Inconsistent cabin climate control: Systems that struggle to heat or cool effectively, draining battery faster than necessary

- Thermal runaway concerns: Though rare, some early models experienced battery thermal events requiring recalls

An Xpeng G3 owner in Thailand described: “During hot season, the car would refuse to fast charge, saying battery temperature too high. I’d have to wait 30-45 minutes in the heat before it would accept charging.”

Service, Warranty, and Parts Availability Problems

A reliable vehicle becomes unreliable when you can’t get it serviced. This is perhaps the most underestimated of the common problems with Chinese EVs.

Dealer Network Gaps

Chinese EV manufacturers are expanding globally faster than they can build service infrastructure. The result is inadequate dealer networks with undertrained technicians.

In many markets:

- Only one or two authorized service centers exist per major city

- Wait times for appointments extend weeks or months

- Technicians lack experience diagnosing and repairing these vehicles

- Diagnostic equipment and software updates aren’t readily available

A NIO ES8 owner in Germany explained: “The nearest authorized service center is 200km away. When I had a problem, they couldn’t diagnose it without remote assistance from China, which took three weeks to arrange. My car sat immobile for nearly a month.”

This contrasts sharply with established brands where service centers are ubiquitous and technicians have decades of institutional knowledge.

Spare Parts Delays

When repairs require replacement parts, owners face extended delays. Many Chinese EV manufacturers haven’t established local parts warehouses, meaning components must be shipped from China.

This creates situations where minor repairs—a damaged door mirror, a faulty sensor, trim pieces—take months to complete because parts aren’t in stock.

Moreover, some manufacturers don’t make repair manuals or diagnostic tools available to independent mechanics, forcing owners to use official dealers even for simple repairs.

Second-order insight: A reliable car without accessible, efficient support infrastructure becomes unreliable in practice. The vehicle’s inherent quality matters less than the ecosystem supporting it.

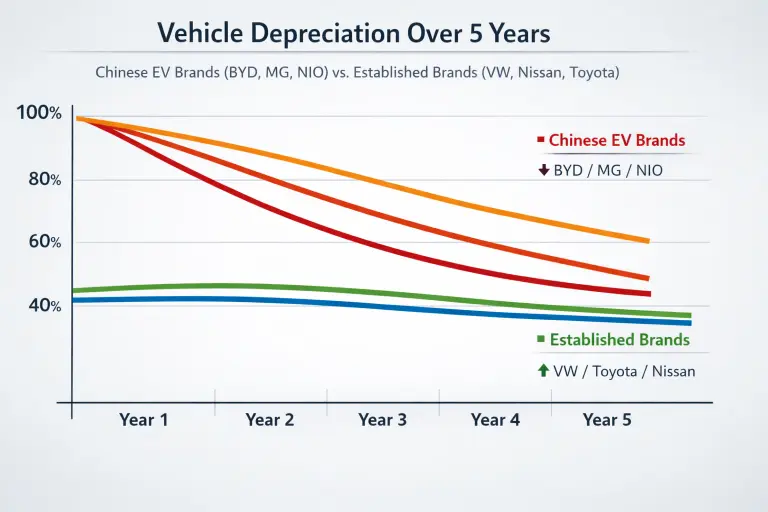

Resale Value and Depreciation Issues With Chinese EVs

When buying any vehicle, resale value matters—it determines your total cost of ownership. Unfortunately, this is where Chinese EVs face their steepest challenges.

Rapid Depreciation Rates

Early data shows Chinese EVs depreciating 20-30% faster than established brands. A three-year-old BYD or MG might retain only 45-50% of its original value, compared to 60-65% for a comparable Volkswagen or Nissan.

Several factors drive this:

- Brand uncertainty: Buyers fear manufacturers might exit markets, leaving them with unsupported vehicles

- Battery degradation concerns: Potential buyers worry about expensive battery replacements

- Limited track record: Without 10-year reliability data, buyers discount prices to compensate for unknown risks

This depreciation hits early adopters hardest. Someone who purchased a Chinese EV three years ago faces significant losses when trying to sell or trade in.

Brand Trust and Longevity Concerns

Market perception remains a powerful force. Despite improving quality, Chinese EV brands haven’t yet built the trust that comes from decades of presence.

Potential buyers ask:

- Will this brand still operate in my market in five years?

- If the company exits, who will honor warranties or provide parts?

- Do these vehicles have the longevity to last 10-15 years like traditional cars?

These questions—whether fair or not—suppress resale values and create risk for buyers.

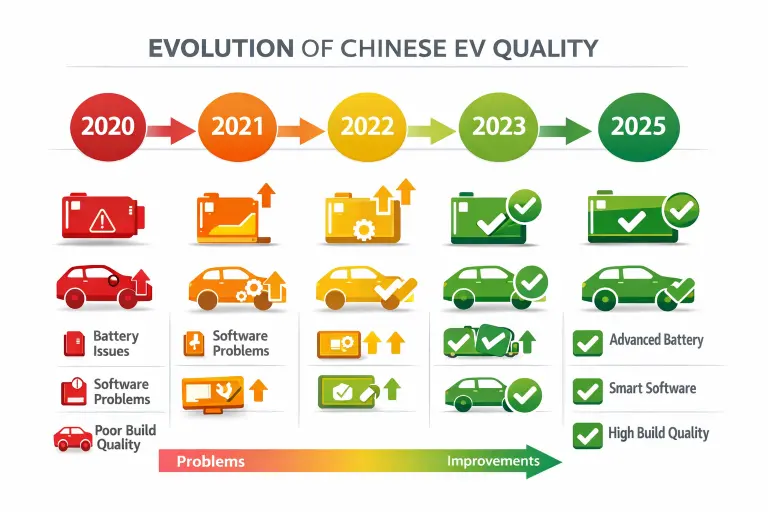

Are Common Problems With Chinese EVs Improving in Newer Models?

The landscape isn’t static. Chinese EV manufacturers are learning, iterating, and improving at remarkable speed.

What Has Improved Significantly

Recent models show substantial progress in key areas:

Battery chemistry and management: BYD’s Blade Battery (LFP chemistry) offers exceptional stability and longevity. Newer thermal management systems better handle extreme temperatures.

Software stability: Second and third-generation infotainment systems are notably more stable than early versions. Over-the-air update processes have matured, with fewer problematic releases.

Build quality consistency: Manufacturers have invested heavily in production quality control. Panel gaps, assembly issues, and material quality have improved measurably in 2023-2024 models compared to 2020-2021 launches.

Safety system calibration: ADAS features in newer vehicles show better tuning, with fewer phantom braking complaints and more natural lane-keeping behavior.

Issues That Still Persist

However, some challenges resist quick fixes:

After-sales infrastructure: Building dealer networks and training technicians takes years. This remains a fundamental weakness in most markets outside China.

Long-term durability uncertainty: No amount of accelerated testing replaces actual years on the road. We simply don’t yet know how a 2024 BYD Seal will perform in 2034.

Spare parts logistics: Global supply chains for replacement parts remain immature, creating extended repair times.

Resale value perception: Trust builds slowly. Even as quality improves, market perception lags by several years.

Therefore, while the common problems with Chinese EVs are becoming less frequent and severe, they haven’t been eliminated—especially the infrastructure and perception challenges.

How to Avoid Common Problems With Chinese EVs

If you’re considering a Chinese EV, these strategies significantly reduce your risk of encountering serious issues:

Buy second-generation or facelift models: Avoid being a beta tester. Wait for a model to be on the market for 18-24 months before purchasing. Early production problems will have been identified and corrected.

Verify local service coverage: Before purchasing, identify the nearest authorized service center. Visit it, ask about typical wait times, and gauge their capability. If the nearest center is hours away, reconsider.

Read long-term owner reviews, not launch impressions: Professional reviews based on week-long test drives miss problems that emerge over months. Seek out owner forums, social media groups, and long-term ownership testimonials.

Prioritize warranty terms over features: A comprehensive warranty with roadside assistance and loaner vehicles provides crucial protection. Don’t be swayed by an extra inch of screen size if warranty coverage is limited.

Consider total cost of ownership: Factor in likely depreciation, insurance costs (which may be higher for unfamiliar brands), and potential repair expenses. The cheapest purchase price rarely equals the lowest total cost.

Test in conditions you’ll actually use: If you drive in extreme cold or heat, insist on testing the vehicle in those conditions. Check real-world charging speeds, not specifications.

Owner Complaints by Brand: Common Chinese EV Problems

| Brand | Most Frequent Complaints | Standout Issues |

|---|---|---|

| BYD | Software glitches, service network gaps | Infotainment system lag, localization issues |

| MG | Build quality inconsistency, material wear | Interior trim rattles, faster depreciation |

| NIO | Limited service infrastructure, premium pricing | Battery subscription complexity, service accessibility outside China |

| Chery | Spare parts availability, ADAS calibration | Phantom braking, long repair times |

| Geely | Software stability, suspension wear | System reboots, premature bushing failure |

| Xpeng | Thermal management, charging issues | Overheating in hot climates, DC charging throttling |

Note: These represent owner-reported issues aggregated from forums, surveys, and social media. Individual experiences vary.

Chinese EV Problems vs Tesla & Korean EVs: How Do They Compare?

Context matters. How do the common problems with Chinese EVs stack up against established EV competitors?

Versus Tesla:

- Software: Tesla’s software is significantly more mature and stable, though not problem-free

- Build quality: Early Teslas had notorious quality issues; recent Chinese EVs show similar inconsistency

- Service: Tesla’s service network, while imperfect, is more developed in most markets

- Resale value: Tesla holds value better, though depreciation has increased with price cuts

- Verdict: Tesla offers more refined software and better infrastructure, but at substantially higher prices

Versus Korean EVs (Hyundai/Kia):

- Reliability: Hyundai/Kia EVs benefit from decades of automotive experience, showing better long-term durability

- Service: Korean brands have extensive, mature dealer networks

- Features: Chinese EVs typically offer more features for the price

- Battery issues: Both have experienced some battery concerns; Chinese EVs show wider variation by model

- Verdict: Korean EVs offer safer, more proven choices; Chinese EVs offer better value for risk-tolerant buyers

The key takeaway: Chinese EVs aren’t categorically worse than competitors—they trade proven reliability and infrastructure for innovation and affordability. Your risk tolerance determines whether that trade-off makes sense.

Frequently Asked Questions About Chinese EV Problems

What is the most common problem with Chinese electric vehicles?

The most common problem with Chinese EVs is the inadequate after-sales service network in markets outside China. While vehicle quality is improving, limited service centers, undertrained technicians, and slow parts availability create frustration for owners when repairs are needed.

Do Chinese EVs have battery problems?

Some Chinese EVs experience battery-related issues including faster-than-expected degradation in older models, real-world range falling significantly short of advertised figures, and thermal management problems in extreme temperatures. However, newer models with advanced battery chemistry, particularly BYD’s Blade Battery, show substantial improvements.

Are Chinese EVs reliable long-term?

Long-term reliability data is still limited since most Chinese EVs have been in international markets for less than five years. Early indicators show mixed results—some components wear prematurely, but major powertrain reliability appears reasonable. The biggest uncertainty is parts availability and service support over a 10-15 year ownership period.

Why do Chinese EVs depreciate so quickly?

Chinese EVs depreciate faster than established brands due to several factors: limited brand trust, concerns about manufacturer longevity in international markets, uncertainty about long-term reliability, fear of expensive battery replacements outside warranty, and inadequate service infrastructure. As brands build track records, depreciation rates should improve.

Which Chinese EV brand is most reliable?

BYD currently shows the strongest reliability indicators among Chinese EV brands, particularly models equipped with Blade Battery technology. The company’s vertical integration and longer operating history contribute to better quality control. However, “most reliable” is relative—no Chinese EV brand yet matches the proven long-term reliability of Toyota, Lexus, or Honda.

Should I buy a Chinese EV or wait?

The answer depends on your risk tolerance and priorities. Buy now if you prioritize affordability, can access adequate local service support, and don’t mind being an early adopter with potential resale value concerns. Wait if you prefer proven reliability, need extensive service network access, or plan to keep the vehicle 10+ years.

Conclusion: Are the Common Problems With Chinese EVs Deal-Breakers?

After examining battery issues, software glitches, build quality concerns, service network gaps, and depreciation challenges, one question remains: are the common problems with Chinese EVs serious enough to avoid them entirely?

The honest answer is: it depends on you.

Chinese EVs aren’t inherently “bad” vehicles. Many offer genuine value—impressive technology, solid range, and prices that make electric mobility accessible to buyers previously priced out of the EV market. A BYD Seal or MG4 can serve reliably as a daily driver, particularly for buyers with realistic expectations and access to adequate service support.

However, these vehicles come with real trade-offs. You’re accepting less proven reliability, potentially frustrating service experiences, and steeper depreciation in exchange for lower purchase prices and advanced features. This calculation works for some buyers—particularly those with second vehicles, shorter ownership timelines, or high risk tolerance. It doesn’t work for everyone.

Who should buy a Chinese EV?

- Buyers prioritizing affordability over brand prestige

- Early adopters comfortable with some inconvenience

- Those with accessible, competent local service support

- Buyers planning 3-5 year ownership rather than 10+ years

- City drivers with home charging (reducing range anxiety)

Who should wait?

- Buyers needing absolute reliability for single-vehicle households

- Those in areas with limited service infrastructure

- Anyone planning very long-term ownership (10-15 years)

- Buyers for whom resale value is a primary concern

- Those requiring extensive road trips beyond reliable charging corridors

The landscape will continue improving. Second and third-generation models show meaningful progress. Service networks are expanding. Long-term reliability data is accumulating. In three to five years, many current concerns may be substantially resolved.

But today, in late 2025, buying a Chinese EV requires clear-eyed assessment of both potential rewards and real risks. The common problems with Chinese EVs aren’t dealbreakers for everyone—but they’re factors you can’t afford to ignore.

Closing insight: Chinese EVs are not “bad”—they are evolving faster than trust can keep up. For the right buyer in the right circumstances, they represent genuine opportunity. For others, patience while the industry matures remains the wiser path.

The choice is yours. Just make sure it’s an informed one.

For more guidance on choosing the right electric vehicle for your needs, explore our comprehensive EV buyer’s guide. You can also find detailed reliability ratings and owner reviews at trusted sources like Consumer Reports and What Car?.