The real cost of owning an electric car averages $400-$650 per month for a mid-range EV like a Tesla Model 3 or Chevy Equinox EV, including payment, insurance, charging, and maintenance. That’s often $80-$150 less than an equivalent gas car when you factor in fuel savings and minimal service costs. This breakdown is for buyers comparing EVs to traditional cars—not for luxury shoppers or those who already know EVs save money long-term.

If you’re leasing high-end EVs or buying used beaters for cash, these numbers won’t apply to your situation.

Breaking Down the Monthly Cost of Owning an Electric Car

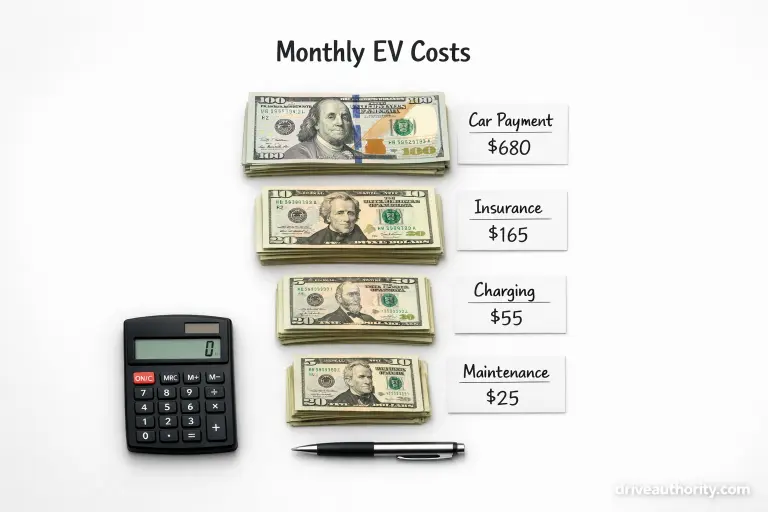

Let’s use a $42,000 EV financed over 60 months at 6.5% APR with $5,000 down. Here’s what you’re actually paying:

Car payment: $680/month Insurance: $150-$180/month (15-25% higher than gas cars) Home charging: $45-$65/month (12,000 miles annually at $0.12/kWh) Maintenance: $25/month average Total: $900-$950/month

But wait—subtract the $7,500 federal tax credit if you qualify, which effectively reduces your down payment or monthly cost by $125/month over five years. Your real monthly total drops to $775-$825.

Now compare this to a $38,000 gas SUV with similar payments. You’re spending $180-$220/month on fuel at $3.50/gallon and 28 mpg. Add $75/month for oil changes, brake service, and transmission maintenance. The gas car costs $935-$1,015/month—roughly $110-$190 more monthly.

The cost of owning an electric car only makes sense when you can charge at home. Public charging at $0.43-$0.56/kWh erases most savings.

Home Charging vs Public Charging: The Make-or-Break Factor

Home charging is where EV economics actually work. Installing a 240V Level 2 charger costs $600-$1,200 upfront but pays for itself within 18-24 months through avoided public charging fees.

Here’s the math: charging a 75 kWh battery at home costs $9-$10.50 at typical residential rates ($0.12-$0.14/kWh). That same charge at a public fast charger costs $32-$42. If you charge twice weekly at public stations instead of home, you’re spending an extra $100-$135 monthly—completely negating EV savings.

Real-world example: my neighbor bought a Hyundai Ioniq 5 without home charging capability at his apartment. He relies on an Electrify America station 8 minutes away, charging twice weekly at $0.48/kWh. His monthly charging cost averages $165 versus the $55 he’d pay at home. Over five years, that’s $6,600 in unnecessary expenses.

Time-of-use electricity rates can reduce costs further. Many utilities offer EV-specific plans charging $0.06-$0.09/kWh overnight. If you charge after 11 PM, that 75 kWh battery costs just $4.50-$6.75 to fill. Suddenly, your monthly charging expense drops to $25-$35.

The charging infrastructure question matters beyond cost. Tesla Supercharger reliability remains unmatched. If you’re buying a non-Tesla EV, verify charging availability within 5 miles of your home and workplace before committing. Apps like PlugShare show real-time charger status and user reviews.

Hidden Costs and Savings in EV Ownership

Insurance companies charge 15-25% more for EVs because repair costs are higher. A Tesla Model 3 costs roughly $1,800-$2,150 annually to insure versus $1,450-$1,700 for a comparable Honda Accord. However, you’ll save $600-$900 yearly on maintenance.

EVs need tire rotations ($80 twice yearly) and cabin air filters ($40 annually). That’s it. No oil changes ($60-$80 quarterly), no transmission service ($200 every 30,000 miles), no spark plugs, no exhaust systems. Over five years, you’ll spend roughly $1,500 on EV maintenance versus $4,500-$5,500 on a gas car.

Brake wear is dramatically reduced thanks to regenerative braking. Most EV owners don’t replace brake pads until 70,000-100,000 miles compared to 30,000-50,000 miles in gas cars. That’s $350-$500 saved every few years.

Registration fees vary wildly by state. Some states add EV surcharges ($100-$200 annually) to offset lost gas tax revenue. Others offer reduced registration or HOV lane access. Check your state’s specific policies—these fees can add $8-$17 monthly to ownership costs.

Battery degradation affects long-term value but not immediate monthly costs. Most EVs retain 90% capacity after 100,000 miles, according to research from Recurrent Auto. Warranties typically cover eight years/100,000-120,000 miles, protecting you during the ownership period most people keep their cars.

Resale value impacts your effective monthly cost if you trade vehicles every 3-5 years. Teslas hold 60-70% value after three years. Many other EVs retain 50-60%. That’s comparable to gas cars, though luxury EVs depreciate faster (45-55%).

Calculate Your Actual Monthly Cost of Owning an Electric Car

Before buying, run these numbers with your specific situation:

- Verify your electricity rate through your utility bill (look for per-kWh cost)

- Calculate monthly charging cost: (miles driven monthly ÷ 3.5) × your kWh rate

- Get real insurance quotes for specific EV models you’re considering

- Factor in available tax credits (federal + state) to reduce effective purchase price

- Add charging installation cost ($600-$1,200) amortized over 60 months if needed

A $35,000 Chevy Equinox EV with the federal tax credit costs effectively $27,500. Financed over 60 months at 6.5%, that’s $535/month versus $680 for the full price.

For detailed cost breakdowns and state-specific incentives, check our complete EV buying guide before finalizing your purchase.

The Bottom Line on Electric Car Monthly Costs

The cost of owning an electric car typically runs $400-$650 monthly for mid-range EVs when you include all expenses—but only if you charge at home. Without home charging, add $100-$150 monthly, erasing most financial advantages over gas cars.

Your next step: calculate your exact scenario using your electricity rate, driving patterns, and available incentives. Test drive your top choices, then verify charging installation feasibility at your home. If the numbers work and you can charge at home, an EV will likely save you $1,000-$2,000 annually compared to gas—making it one of the smarter financial decisions in transportation today.