Are Chinese EVs as Good as Tesla? A Category-by-Category Reality Check (2026)

The electric vehicle market has reached a turning point. Chinese automakers are flooding global showrooms with EVs that cost less, charge faster, and—in some cases—outperform the brand that defined the category. Meanwhile, Tesla remains the default choice for millions of buyers who equate “electric vehicle” with “Tesla.”

If you’re considering an EV in 2026, you’ve likely asked yourself: are Chinese EVs as good as Tesla? The question matters because your answer determines whether you’ll spend $45,000 on a Model 3 or $28,000 on a BYD Seal with similar specs. It shapes whether you trust a decade-old brand or a newcomer with ambitious technology.

However, understanding whether Chinese EVs are as good as Tesla requires reframing the question entirely. “As good as” depends entirely on what you value: raw performance, software maturity, interior luxury, charging infrastructure, or simply getting the most car for your money. This article breaks down the comparison category by category, so you can make an informed decision based on your real-world priorities—not brand loyalty or internet hype.

Short Answer First — Are Chinese EVs as Good as Tesla?

Sometimes yes, sometimes better—but not across all categories.

Here’s the breakdown:

Where Chinese EVs already match or exceed Tesla:

- Interior materials, comfort, and tech features

- Battery safety and thermal stability (especially LFP chemistry)

- Price-to-performance ratio

- Hardware innovation speed

Where Tesla still holds a structural advantage:

- Software ecosystem maturity and over-the-air updates

- Supercharger network reliability (especially in North America and Europe)

- Autonomous driving development and real-world data scale

- Global service infrastructure and resale value

Why brand-level answers mislead: Not all Chinese EVs are created equal. BYD’s manufacturing scale differs vastly from XPeng’s software ambitions or NIO’s premium positioning. Similarly, Tesla’s strengths in software don’t erase its well-documented build quality issues.

The reality? Chinese EVs as good as Tesla have become in many categories—they’ve closed the gap faster than most Western buyers realize. Still, the right choice depends on where you live, how you drive, and what you refuse to compromise on.

Why Tesla Became the EV Benchmark in the First Place

Before we can properly evaluate Chinese competitors, we need to understand why Tesla became the standard against which all electric vehicles are measured.

Battery Efficiency That Set the Standard

Battery efficiency and real-world range leadership set Tesla apart early. The company’s relentless focus on energy density meant its vehicles traveled farther per kilowatt-hour than competitors. Even today, a Model 3 Long Range achieves approximately 4.1 miles per kWh—a figure few rivals match.

Software Architecture That Changed Everything

Software-first vehicle architecture transformed what a car could be. Tesla treated vehicles as computers on wheels, enabling meaningful improvements through over-the-air updates. Features appeared overnight. Performance increased without visiting a service center. This approach fundamentally changed buyer expectations and established new standards for automotive software development.

The Supercharger Moat

The Supercharger network created a structural moat. While other automakers relied on fragmented third-party charging, Tesla built a proprietary network that simply worked. Fast, reliable, and strategically placed, Superchargers eliminated range anxiety for long-distance travel.

Moreover, Tesla opened its Supercharger network to other EVs in select markets, but Teslas still receive priority access and the most seamless experience.

Data Advantage in Autonomous Driving

Data scale advantage in autonomy development remains significant. With millions of Tesla vehicles collecting real-world driving data, the company possesses a training dataset no competitor can easily replicate. This feeds directly into Full Self-Driving development, creating a compounding advantage.

Understanding these strengths prevents us from dismissing Tesla unfairly. Chinese automakers aren’t competing against a flawed product—they’re challenging a company that fundamentally reshaped the automotive industry.

Who Are Tesla’s Real Chinese EV Competitors? (Not All Are Equal)

The phrase “Chinese EVs” obscures critical distinctions. These companies pursue different strategies, target different buyers, and operate at vastly different scales.

BYD: Manufacturing Scale and Vertical Integration

BYD dominates through vertical integration and manufacturing scale. The company produces its own batteries (Blade Battery technology), semiconductors, and even some raw materials. This allows aggressive pricing without sacrificing margins. BYD sold over 3 million EVs and plug-in hybrids in 2024, making it the world’s largest EV manufacturer by volume. Models like the Seal and Dolphin target mainstream buyers with compelling value propositions.

NIO: Premium Experience and Community

NIO positions itself as the Chinese Tesla—or more accurately, the Chinese Mercedes of EVs. Premium materials, attention to detail, and innovative battery swapping infrastructure define the brand. NIO houses across China and Europe offer lounge spaces where owners can work, socialize, or relax. The company bets that EV ownership should feel like membership in an exclusive community.

XPeng: Software and Autonomy Focus

XPeng focuses relentlessly on software and autonomous driving. The company’s XNGP (XPeng Navigation Guided Pilot) system rivals Tesla’s Autopilot in urban environments, particularly within China. XPeng positions itself as the tech-forward choice for buyers who care more about AI capabilities than leather quality.

Zeekr and Geely: Global Engineering Ambition

Zeekr and Geely represent global engineering ambition. Built on Geely’s SEA (Sustainable Experience Architecture) platform, Zeekr vehicles combine European chassis tuning with Chinese manufacturing efficiency. The brand targets performance enthusiasts willing to pay premium prices for dynamics that challenge European sports sedans.

SAIC’s MG: Export-Focused Affordability

SAIC’s MG brand leads export-focused affordability. The MG4 and MG ZS EV bring electric mobility to price-conscious European and Middle Eastern buyers. These aren’t luxury vehicles—they’re practical, reliable transportation at accessible prices.

This diversity matters. Comparing “Chinese EVs” to Tesla makes as much sense as comparing “German cars” to Ford. Each brand solves different problems for different buyers, making the question of whether Chinese EVs are as good as Tesla impossible to answer without specifying which Chinese brand.

Performance and Driving Experience — Spec Sheets vs Reality

On paper, many Chinese EVs embarrass Tesla’s acceleration figures. The Zeekr 001 FR sprints to 60 mph in 2.07 seconds, edging out even the Model S Plaid. However, straight-line speed tells only part of the performance story.

Acceleration and Power Delivery

Acceleration and power delivery favor electric motors universally. Both Tesla and Chinese competitors deliver instant torque and seamless power application. The difference emerges in tuning philosophy: Tesla prioritizes consistent, predictable responses, while some Chinese automakers (particularly Zeekr and XPeng) offer more aggressive, sport-oriented calibrations.

Handling and Chassis Dynamics

Handling and chassis tuning reveal deeper engineering philosophies. Tesla vehicles, especially the Model 3 Performance, exhibit sharp turn-in and confidence-inspiring balance. The low center of gravity from floor-mounted batteries helps, but so does suspension tuning developed through years of iteration.

Chinese EVs vary widely here. NIO’s ET5 handles competently but feels softer, prioritizing comfort over cornering precision. Zeekr models surprise enthusiasts with genuinely engaging dynamics. BYD’s mainstream offerings drive smoothly but don’t invite spirited driving.

Real-World Range Efficiency

Real-world range versus claimed range separates marketing from reality. Tesla’s EPA and WLTP estimates generally prove conservative—most owners exceed official figures in moderate conditions. Chinese EV range claims can be optimistic, particularly for models using older battery technology. Moreover, highway efficiency at 70+ mph tends to favor Tesla’s aerodynamic designs and motor efficiency.

Thermal Management Under Stress

Thermal management under sustained driving matters more than most buyers realize. Push a Model 3 Performance hard on a track, and it manages heat effectively for multiple sessions. Some Chinese EVs, particularly budget models, exhibit more aggressive power derating when batteries heat up. This rarely affects daily driving but matters for enthusiast use.

The verdict? For pure performance thrills, both Tesla and premium Chinese brands deliver. For sustained, repeatable performance in varied conditions, Tesla’s refinement shows. When evaluating whether Chinese EVs are as good as Tesla for performance, the answer depends heavily on which specific models you’re comparing.

Battery Technology — Are Chinese EV Batteries as Good as Tesla’s?

Battery technology represents the heart of any electric vehicle comparison, and here, the gap has narrowed dramatically—in some ways, Chinese manufacturers have pulled ahead.

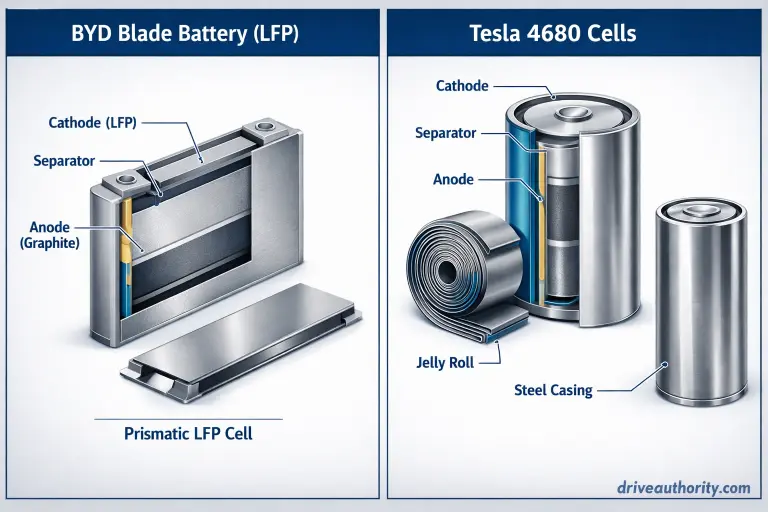

BYD Blade Battery vs Tesla Cylindrical Cells

BYD’s Blade Battery versus Tesla’s cylindrical cells illustrates different engineering philosophies. Tesla uses cylindrical cells (currently 4680 format in newer vehicles) emphasizing energy density—more range from less weight. BYD’s Blade Battery uses lithium iron phosphate (LFP) chemistry in a cell-to-pack design, prioritizing safety and longevity over absolute energy density.

LFP vs NMC Chemistry Trade-offs

LFP versus NMC trade-offs shape ownership experience profoundly. Nickel-manganese-cobalt (NMC) batteries, like those in long-range Tesla models, offer higher energy density, translating to more miles per charge. However, they’re more expensive, less stable at high temperatures, and degrade faster over many charge cycles.

LFP batteries, common in Chinese EVs and Tesla’s Standard Range models, sacrifice some energy density but excel in cycle life, thermal stability, and cost efficiency. If you plan to keep your EV for 10+ years, LFP’s superior longevity matters. Research from the National Renewable Energy Laboratory confirms LFP’s longevity advantages in specific use cases.

Long-Term Degradation Patterns

Degradation patterns and heat tolerance reveal long-term quality. Tesla’s battery management systems remain industry-leading, carefully balancing charging speed, thermal control, and longevity. Data from high-mileage Tesla vehicles shows approximately 10% degradation after 200,000 miles.

Chinese EV battery data is emerging but looks promising, particularly for BYD’s Blade Battery and CATL-supplied packs. Early reports suggest comparable or better retention in moderate climates.

Cost Efficiency Impact on Pricing

Cost efficiency versus energy density explains pricing disparities. BYD manufactures batteries in-house at costs reportedly 30-40% below competitors. This advantage flows directly to buyers through lower MSRPs. Tesla’s vertical integration helps, but the company still purchases cells from suppliers like Panasonic and CATL.

Are Chinese EV batteries as good as Tesla’s? For safety and longevity, yes—often better, especially with LFP chemistry. For maximum range per kilogram, Tesla’s NMC packs retain an edge. The right answer depends on your priorities.

Software, Autonomy, and the “Smart Car” Gap

This category represents Tesla’s most defensible competitive moat—and where Chinese automakers are investing billions to catch up.

Tesla’s Autopilot and FSD Capabilities

Tesla Autopilot and Full Self-Driving (FSD) operate on fundamentally different levels. Autopilot, the standard system, handles adaptive cruise control and lane-keeping competently on highways. It works reliably in most conditions but requires constant driver supervision.

FSD (Beta/Supervised) promises city driving automation but remains imperfect and controversial. It navigates complex urban environments impressively at times, yet makes unpredictable mistakes that demand intervention.

Chinese ADAS Systems Rising

Chinese ADAS systems have evolved rapidly. XPeng’s XNGP (XPeng Navigation Guided Pilot) genuinely rivals Autopilot in urban Chinese environments, handling complex intersections, roundabouts, and even parking structures with minimal intervention. Huawei’s ADS (Advanced Driving System), deployed in vehicles like the AITO M7, demonstrates sophisticated sensor fusion and decision-making. NIO’s NAD (NIO Autonomous Driving) shows promise but lags slightly behind XPeng’s maturity.

However, there’s a critical distinction: these systems perform brilliantly in China, where they’re extensively mapped and tested, but struggle outside their home market. Tesla’s system works globally (with varying capability) because it relies less on HD maps and more on vision-based generalization.

Infotainment Experience and Updates

Infotainment UX and over-the-air update maturity separate polished products from feature-rich prototypes. Tesla’s interface frustrates some users with its minimalism and buried controls, but it responds instantly, never crashes, and improves continuously through OTA updates.

Chinese EV infotainment systems often pack more features—karaoke, gaming, elaborate ambient lighting controls—but can feel laggy or buggy. Update frequency varies: XPeng and NIO push meaningful updates regularly, while budget brands update rarely.

Ecosystem Integration Depth

Ecosystem depth versus feature density matters long-term. Tesla’s software ecosystem integrates charging navigation, energy monitoring, service scheduling, and entertainment seamlessly. You live inside one coherent system. Chinese automakers often excel at individual features—NIO’s voice assistant is remarkably natural, BYD’s rotating screens are fun—but the pieces don’t always integrate elegantly.

The software gap remains real but is closing faster than traditional automakers managed. For buyers prioritizing cutting-edge autonomy and proven software maturity, Tesla leads. For those valuing feature richness and rapid innovation, premium Chinese brands compete credibly. This makes answering whether Chinese EVs are as good as Tesla particularly nuanced in the software domain.

Interior Quality, Comfort, and Build Philosophy

Walk into a NIO ET7 or BYD Han, and you’ll immediately understand why interior quality comparisons favor Chinese EVs—at least in the premium and mid-range segments.

Material Quality and Perceived Luxury

Material quality and perceived luxury reveal different priorities. Tesla’s interiors emphasize minimalism: clean lines, vegan leather, and little else. The Model 3 and Model Y feel spartan to buyers accustomed to traditional luxury.

Chinese EVs, particularly from NIO, Li Auto, and Zeekr, embrace a more traditionally luxurious approach. Expect real wood trim, Nappa leather, ambient lighting, and attention to tactile details. The NIO ET7’s interior rivals Mercedes-Benz in materials quality, at a significantly lower price point.

Ride Comfort and Noise Isolation

Ride comfort and noise isolation tend to favor Chinese automakers. Tesla prioritizes performance and efficiency, sometimes at the expense of comfort—earlier Model 3s especially earned criticism for harsh ride quality over rough pavement.

Chinese brands targeting family buyers engineer softer suspensions and invest heavily in sound deadening. The BYD Han glides over imperfect roads with a serenity that surprises buyers expecting economy-car compromises.

Design Philosophy Differences

Tesla minimalism versus Chinese “tech-lounge” interiors represents a philosophical divide. Tesla believes simplicity reduces distractions and enables OTA improvements without hardware dependencies. Chinese automakers treat the interior as a living space—somewhere you’ll spend hours in traffic, so it should feel like a premium lounge. Rotating screens, massage seats, refrigerated compartments, and elaborate mood lighting become standard equipment.

Owner Satisfaction Trends

Owner satisfaction trends tell a nuanced story. Tesla owners often forgive interior shortcomings because they value performance, charging infrastructure, and software. Chinese EV owners in domestic markets rate interior quality exceptionally highly, but some international buyers feel the “gadget overload” becomes gimmicky after the novelty wears off.

If interior luxury, comfort, and perceived value matter most, Chinese EVs—especially NIO, Li Auto, and premium BYD models—deliver more for less. If you prefer minimalism and don’t mind spartan cabins, Tesla’s approach won’t disappoint.

Reliability and Long-Term Ownership Reality

This category demands intellectual honesty: we’re comparing a brand with 15+ years of owner data against competitors with limited international track records.

Tesla’s Quality Issues and Improvements

Known Tesla quality issues and improvements are well-documented. Panel gaps, paint quality inconsistencies, and occasional build defects plagued early Model 3 production. Tesla’s customer service reputation remains mixed—some owners report excellent experiences, others describe frustrating delays and poor communication.

However, the company has demonstrably improved manufacturing quality, particularly at newer factories. Reliability data shows Tesla vehicles have fewer mechanical issues than traditional cars (fewer moving parts help), but software bugs and electronic glitches occur periodically.

Chinese EV Durability Data Emerging

Chinese EV durability concerns—and where data is improving—require careful examination. Early Chinese EVs earned skepticism about long-term reliability, often fairly. However, major players like BYD and NIO now produce vehicles with impressive build quality. BYD’s vertical integration means they control component quality tightly.

Third-party reliability data from China shows modern Chinese EVs matching or exceeding traditional automakers in initial quality surveys.

The Unknown Factors

The unknowns? We lack 5-10 year international ownership data for most Chinese brands. How will these vehicles age in harsh climates? How will parts availability and software support evolve? These aren’t rhetorical concerns—they’re real risks early adopters assume.

Warranty Coverage Signals Confidence

Warranty length and confidence signaling speak volumes. BYD offers 6-year, 93,000-mile warranties in Europe—signaling confidence in durability. NIO provides 10-year battery warranties. Tesla’s standard warranty (4 years, 50,000 miles) looks modest by comparison, though battery coverage extends to 8 years.

What’s Proven vs Unproven

What’s known versus what’s still unproven: Tesla’s long-term reliability is established—batteries degrade predictably, drivetrains last hundreds of thousands of miles, and depreciation curves are well-understood. Chinese EVs show early promise but lack the decade-plus international track record to prove durability conclusively.

Conservative buyers should weight this uncertainty. Early adopters might reasonably bet on improved quality from mature Chinese manufacturers when deciding if Chinese EVs are as good as Tesla for long-term ownership.

Charging and Daily Usability Outside China

Charging infrastructure represents one of Tesla’s most enduring competitive advantages—and a significant challenge for Chinese EV buyers outside China.

Tesla’s Supercharger Network Advantage

Tesla Supercharger advantage globally cannot be overstated, particularly in North America. With over 50,000 Superchargers worldwide, Tesla owners enjoy unmatched convenience for long-distance travel. The stations work reliably, charge quickly, and integrate seamlessly with vehicle navigation. Payment happens automatically—no apps, no RFID cards, no fumbling with broken card readers.

Moreover, Tesla opened its Supercharger network to other EVs in select markets, but Teslas still receive priority access and the most seamless experience.

Public Charging Network Compatibility

Compatibility of Chinese EVs with local charging networks varies dramatically by region. In Europe, CCS2 (Combined Charging System) standardization means Chinese EVs access the same public charging networks as all other EVs. However, this creates a fundamentally different experience: multiple apps, varying reliability, inconsistent pricing, and occasional non-functional stations. The infrastructure exists, but it lacks Tesla’s cohesion.

In the Middle East and North Africa, public charging infrastructure remains limited. Buyers of any EV—Tesla or Chinese—rely heavily on home charging. Tesla’s destination charging network provides some advantage at hotels and resorts, but day-to-day ownership depends primarily on Level 2 home charging for all brands.

Battery Swapping Innovation

Battery swapping: innovation or niche? NIO’s battery swap stations represent genuine innovation—full battery replacement in under 5 minutes. The company operates over 2,000 swap stations in China and is expanding into Europe. For NIO owners in areas with swap coverage, this eliminates charging anxiety entirely. However, the technology remains niche globally, and its long-term viability depends on continued infrastructure investment.

Home Charging Reality

Home charging realities for most owners level the playing field considerably. If you charge overnight at home (which 80%+ of EV owners do primarily), the difference between Tesla and Chinese EVs becomes minimal. Both charge at similar speeds from Level 2 home chargers. Both work with standard home charging equipment. The Supercharger advantage matters primarily for road trips and buyers without home charging access.

North American buyers face Tesla’s most substantial charging advantage. European buyers with home charging see the gap narrow considerably. MENA region buyers find both ecosystems require similar charging planning.

Pricing, Value, and Total Cost of Ownership

Here, Chinese EVs fundamentally challenge the calculus that made Tesla the “affordable” premium EV option.

Price-to-Feature Ratios

Price-to-feature ratios heavily favor Chinese manufacturers. A BYD Seal offers approximately 330 miles of range, premium interior materials, advanced ADAS, and rapid charging for roughly €35,000-€40,000 in Europe. A comparable Tesla Model 3 Long Range costs €50,000+. That €10,000-€15,000 difference buys a lot of gasoline—or covers years of electricity costs.

The value proposition becomes even starker in the budget segment. The MG4 delivers a competent, practical EV for under €30,000. Tesla offers nothing in this price range.

Regional Pricing Variations

Incentives and regional pricing differences complicate direct comparisons. European buyers benefit from various national EV incentives, sometimes favoring domestic production (which helps no one yet) or emissions targets (which helps everyone). Chinese automakers often absorb tariffs and shipping costs to remain price-competitive. In the Middle East, lack of subsidies and import duties can narrow pricing gaps.

Running Costs and Depreciation

Running costs and depreciation expectations introduce uncertainty. Tesla’s running costs are well-documented: low maintenance (no oil changes, fewer brake replacements thanks to regenerative braking), reasonable insurance, and excellent efficiency. According to AAA research, EVs generally cost less to maintain than gas vehicles, with Tesla performing particularly well.

Depreciation has stabilized after dramatic pandemic-era fluctuations—expect 15-20% loss in the first year, then 8-12% annually.

Chinese EV running costs appear similar—electric drivetrains reduce maintenance universally. However, depreciation remains uncertain. Will a 3-year-old BYD Seal retain 60% of its value like a Model 3, or depreciate faster due to brand perception and uncertainty? Early data suggests faster depreciation, but the market is evolving rapidly.

Trade-offs for Lower Upfront Cost

What buyers trade off to save money—realistically: Choosing a Chinese EV over Tesla saves significant upfront cost but introduces risks:

- Less established service networks (improving, but not yet Tesla-level)

- Unknown long-term reliability (likely fine, but unproven internationally)

- Potentially faster depreciation (though gap is narrowing)

- Less comprehensive charging infrastructure (outside China)

For buyers planning to keep vehicles long-term and charge primarily at home, these trade-offs matter less. For those wanting maximum resale value and convenience, Tesla’s premium may be justified.

Safety and Crash Performance

Modern vehicles—EV or otherwise—achieve remarkably high safety standards, and both Tesla and Chinese EVs perform well in standardized testing.

Crash Test Results Comparison

Euro NCAP and C-NCAP results provide objective comparison points. The Tesla Model Y earned a 5-star Euro NCAP rating with impressive scores across adult occupant (97%), child occupant (87%), and safety assist (98%) categories.

Chinese EVs tested by Euro NCAP show similarly strong performance: the BYD Atto 3 earned 5 stars with 89% adult occupant protection and 83% child protection. The NIO ET5 achieved 5 stars with scores nearly matching Tesla.

China’s C-NCAP ratings tend to be slightly more lenient than Euro NCAP, so direct comparison requires care. However, modern Chinese EVs from major manufacturers consistently achieve top ratings in their domestic testing.

Structural Safety Advantages

Passive safety and structural integrity benefit from EV architecture universally. The absence of a large engine in the front creates a substantial crumple zone. Floor-mounted batteries add rigidity to the vehicle structure. Both Tesla and Chinese automakers exploit these advantages.

Tesla emphasizes its proprietary “megacasting” technique for structural components, reducing parts count and potentially improving consistency. Chinese manufacturers use more traditional construction methods, which are well-proven and equally effective.

Active Safety Systems

Active safety systems comparison reveals philosophical differences. Tesla’s Autopilot includes robust active safety features—automatic emergency braking, blind-spot monitoring, and collision avoidance—as standard across all models. These systems work well, though not perfectly, and have prevented countless accidents.

Chinese EVs vary in standard safety equipment by model and price point. Premium brands like NIO include comprehensive ADAS as standard. Budget brands like MG sometimes offer fewer active safety features on base trims, though emergency braking is increasingly mandated by regulation.

Hardware vs Software Safety Approaches

Hardware safety versus software intervention distinguishes approaches. Tesla relies heavily on vision-based systems and software intervention to prevent accidents. Chinese automakers tend to employ more sensors (additional radar, lidar on premium models) for redundancy. Both approaches work, though multi-sensor systems theoretically provide greater reliability in edge cases.

The safety verdict? Both Tesla and major Chinese EV brands build genuinely safe vehicles that perform excellently in crash testing and real-world accident avoidance. Budget Chinese models may lack some advanced features, but meet all regulatory requirements and protect occupants effectively.

Where Chinese EVs Clearly Beat Tesla Today

Objectivity demands acknowledging where Chinese manufacturers have surpassed Tesla, not merely caught up.

Interior Technology and Luxury

Interior technology and comfort represent the clearest Chinese advantage. A NIO ES8 or Li Auto L9 delivers an interior experience Tesla simply doesn’t offer: heated and ventilated front and rear seats, massage functions, refrigerators, premium audio systems, and meticulous material quality. These vehicles feel like luxury products because they are. Tesla’s minimalist cabins, by contrast, feel austere—which is intentional design, but nonetheless leaves some buyers cold.

Price Accessibility

Price accessibility opens EV ownership to millions who find Tesla unaffordable. The MG4, BYD Dolphin, and Ora Good Cat bring competent electric mobility to the €25,000-€35,000 range. Tesla’s cheapest model costs significantly more. This democratization of EV technology matters enormously for widespread adoption.

LFP Battery Advantages

LFP battery safety and durability give Chinese manufacturers a tangible advantage in specific use cases. BYD’s Blade Battery has passed extreme nail penetration tests without thermal runaway—dramatic demonstrations that resonate with safety-conscious buyers. LFP chemistry tolerates frequent charging to 100% without accelerated degradation, simplifying ownership. For ride-sharing fleets, commercial applications, or owners in hot climates, these characteristics prove superior to NMC chemistry.

Hardware Iteration Speed

Faster hardware iteration cycles mean Chinese EVs incorporate the latest technology more rapidly. Tesla’s relatively slow model refresh cycle (the Model S is fundamentally a decade-old design) contrasts with Chinese automakers’ willingness to update vehicles annually. When automotive technology evolves quickly, faster iteration provides tangible advantages.

These aren’t minor victories—they’re substantial competitive strengths that appeal to large segments of the market and definitively answer “yes” when buyers ask if Chinese EVs are as good as Tesla in these specific categories.

Where Tesla Still Holds a Meaningful Lead

Acknowledging Chinese advantages requires equally honest assessment of where Tesla remains ahead.

Software Ecosystem Maturity

Software ecosystem maturity represents Tesla’s deepest moat. The integration of charging navigation, energy management, entertainment, vehicle controls, and service scheduling into one coherent, stable, regularly updated ecosystem creates enormous value. Chinese automakers offer feature-rich systems, but they haven’t yet matched the reliability and cohesion Tesla achieved through years of refinement.

Charging Network Reliability

Charging network reliability matters more than raw charging speed specifications suggest. Knowing you can drive anywhere and find a working, fast charger eliminates the anxiety that still plagues non-Tesla EV ownership in many regions. Until other networks match Supercharger reliability and coverage, Tesla maintains a substantial practical advantage for road-trippers and buyers without home charging.

Service and Resale Infrastructure

Global service and resale strength provide peace of mind. Tesla operates service centers across North America, Europe, and Asia. Parts availability is established. Resale values are predictable. Chinese brands are building service networks, but they’re not yet comprehensive outside China. If something breaks, will you wait weeks for a part? Will your warranty claim be honored smoothly? Tesla’s infrastructure answers these questions clearly.

Autonomy Data Advantage

Data-driven autonomy development positions Tesla for future advantage. The company’s fleet of millions of vehicles collects vast amounts of real-world driving data, feeding machine learning systems that should—theoretically—produce increasingly capable autonomous driving. Chinese companies are pursuing similar strategies, but Tesla’s head start and data scale remain significant.

These advantages don’t make Tesla objectively “better,” but they explain why many buyers still choose Tesla despite higher prices and spartan interiors.

Common Myths That Distort the Chinese EV vs Tesla Debate

Several persistent misconceptions cloud rational comparison, deterring buyers from considering Chinese EVs or creating unrealistic expectations.

Myth: “Chinese EVs Are Cheap Knockoffs”

Myth: “Chinese EVs are cheap knockoffs”

Reality: Modern Chinese EVs from major manufacturers represent sophisticated, original engineering. BYD designs and manufactures its own batteries, motors, and semiconductors. NIO developed its battery swapping technology in-house. XPeng’s ADAS system is genuinely innovative. While early Chinese automotive products sometimes copied Western designs, current EVs compete on innovation, not imitation.

The “cheap knockoff” perception stems from outdated stereotypes. Yes, some budget Chinese consumer products cut corners. No, this doesn’t characterize the automotive industry’s leading players, who invest billions in R&D and operate to international quality standards.

Myth: “Tesla Batteries Are Always Superior”

Myth: “Tesla batteries are always superior”

Reality: Battery superiority depends entirely on the application and chemistry. Tesla’s NMC batteries achieve higher energy density—meaningful for maximum range. However, BYD’s LFP Blade Batteries excel in safety, longevity, and cost-efficiency. For buyers prioritizing these factors over absolute range, the Chinese battery proves superior.

Moreover, Tesla itself uses Chinese-made LFP batteries in Standard Range models, acknowledging their advantages for certain applications.

Myth: “Chinese EV Software Is Unreliable”

Myth: “Chinese EV software is unreliable”

Reality: Software quality varies dramatically by manufacturer, just as it does among Western automakers. Premium Chinese brands like NIO and XPeng deliver stable, feature-rich software experiences with regular updates. Budget brands may lag, but so do budget Western alternatives.

The myth persists partly because early Chinese EVs did suffer software issues, and partly because Western media rarely tests Chinese vehicles comprehensively.

Myth: “Tesla Has No Real Competition”

Myth: “Tesla has no real competition”

Reality: In China—the world’s largest EV market—Tesla ranks behind BYD in sales. Globally, Tesla faces genuine competition not just from Chinese brands but from Hyundai/Kia, BMW, Mercedes, and others. Tesla’s first-mover advantage and Supercharger network provide insulation, but the company absolutely faces meaningful competition in product quality, features, and price.

The “no competition” narrative served Tesla well for years, but it no longer reflects market reality in 2026. Asking whether Chinese EVs are as good as Tesla now yields answers that would have seemed impossible just five years ago.

Are Chinese EVs as Good as Tesla for Buyers Outside China?

This question matters because context shapes the answer dramatically. An EV’s suitability depends not just on the vehicle but on the infrastructure, regulatory environment, and support ecosystem surrounding it.

Export Model Differences

Export models versus China-only versions sometimes differ materially. Chinese automakers occasionally equip domestic models with features unavailable internationally, or vice versa. For example, certain advanced driver assistance features that work brilliantly in China may be disabled in European exports due to regulatory approval processes. Always verify that the specific export model includes the features you’re considering.

Software Localization Quality

Software localization and compliance affect user experience. Navigation systems optimized for Chinese cities may struggle with European addressing systems. Voice assistants trained on Mandarin may misunderstand English commands. Payment integrations that work seamlessly in China might not support local payment methods abroad. Established Chinese brands entering international markets address these issues, but buyers should verify localization quality before purchasing.

Service Network Readiness

Parts, servicing, and long-term support represent the most significant concern for international buyers. If you live in Berlin, Paris, or Dubai and your BYD requires a specialized component, how quickly can it be delivered? How many qualified technicians can diagnose and repair it? These practical considerations matter enormously for long-term satisfaction.

The good news: major Chinese manufacturers are rapidly expanding international service networks. BYD has established service centers across Europe and the Middle East. NIO operates “NIO Houses” and service facilities in multiple European countries. However, coverage remains less comprehensive than Tesla’s, particularly in smaller cities and rural areas.

Buyers Who Should Proceed Cautiously

Which buyers should proceed cautiously:

- Those without reliable home charging who depend on public infrastructure

- Buyers in regions with limited Chinese brand service presence

- People who prioritize maximum resale value and depreciation predictability

- Road-trip enthusiasts who regularly drive 300+ miles from home

- Those who want the most mature, proven autonomous driving systems

None of these considerations makes Chinese EVs unsuitable—they simply identify use cases where Tesla’s established ecosystem provides tangible advantages.

So—Are Chinese EVs as Good as Tesla?

After examining performance, battery technology, software, build quality, reliability, safety, and ownership costs, the answer crystallizes: Chinese EVs are as good as Tesla in many categories, and have become genuinely competitive alternatives—in some areas, they’re demonstrably superior—but the right choice depends entirely on your priorities and location.

When Tesla Remains the System Leader

Tesla remains the system leader if you value:

- Software maturity and over-the-air update frequency

- Charging convenience for long-distance travel

- Established service infrastructure globally

- Proven long-term reliability data

- Autonomous driving development potential

Where Chinese EVs Lead

Chinese EVs lead when you prioritize:

- Maximum value for money

- Interior comfort, luxury, and technology features

- Battery safety and longevity over maximum range

- Supporting rapid innovation and newer technology

Who Should Choose Tesla in 2026

- North American buyers who road-trip frequently

- Anyone without home charging access

- Buyers who want maximum resale value

- Those who prioritize the most refined software experience

- People living in areas with limited Chinese brand service infrastructure

Who Should Consider Chinese EVs

**Who should seriously consider Chinese EVs in 2026

- European and MENA buyers with home charging

- Budget-conscious shoppers seeking maximum features per dollar

- Luxury-oriented buyers who value traditional premium interior quality

- Environmentally conscious drivers who prioritize LFP battery sustainability

- Early adopters comfortable with newer brands establishing international presence

- Families prioritizing interior space, comfort, and passenger amenities

- Urban drivers who rarely take long road trips beyond their city or region

- Tech enthusiasts excited by rapid feature innovation and frequent updates

- Buyers who view cars as comfortable living spaces, not just transportation

- Fleet operators and rideshare drivers valuing lower upfront costs and LFP longevity

Regional Considerations Matter

The question of whether Chinese EVs are as good as Tesla varies significantly by geography:

For European buyers: Chinese EVs make compelling sense. CCS2 charging standardization eliminates infrastructure concerns. Service networks from BYD, NIO, and MG are expanding rapidly across major European markets. Competitive pricing, combined with generous interior appointments, creates exceptional value. Moreover, European driving patterns—shorter average distances, extensive urban driving—play to Chinese EV strengths while minimizing Tesla’s Supercharger advantage.

For MENA buyers: The calculation becomes more nuanced. Limited public charging infrastructure means both Tesla and Chinese EVs depend heavily on home charging, leveling that particular playing field. However, extreme temperatures test thermal management systems rigorously—an area where both Tesla and premium Chinese brands perform adequately, though long-term data in these conditions remains limited for Chinese vehicles. Price sensitivity in many MENA markets favors Chinese EVs significantly, particularly brands like MG that offer accessible entry points to electric mobility.

For North American buyers: Tesla’s advantages remain most pronounced. The Supercharger network’s density and reliability, combined with established service infrastructure, provide tangible daily benefits. Chinese EV presence remains minimal in North America due to tariffs, regulatory hurdles, and limited distribution networks. However, this may evolve—BYD and other manufacturers are exploring North American market entry strategies that could change the landscape within 2-3 years.

Specific Use Case Recommendations

Daily commuters (under 50 miles daily): Either option works excellently. Home charging eliminates range anxiety for both. Chinese EVs often provide better value and comfort for this use case, making the answer to “are Chinese EVs as good as Tesla” a definitive yes for commuters. The BYD Seal or MG4 delivers everything you need at a lower price point.

Road trip enthusiasts: Tesla maintains a significant edge in North America and parts of Europe. Supercharger reliability and integration matter enormously when you’re 200 miles from home. Chinese EVs work for road trips but require more planning and patience with public charging networks.

Tech-focused buyers: This depends on your definition of “tech.” If you prioritize autonomous driving maturity and seamless software integration, Tesla leads. If you want the latest hardware features, elaborate infotainment, and rapid innovation cycles, premium Chinese brands like XPeng and NIO compete credibly—sometimes exceeding Tesla in feature richness.

Luxury seekers on a budget: Chinese EVs definitively win. NIO, Li Auto, and premium BYD models deliver Mercedes-level interior quality at Toyota-level prices. Tesla’s minimalist approach, while intentional, simply doesn’t compete on perceived luxury per dollar spent.

Families with children: Chinese EVs often excel due to superior rear-seat comfort, quieter cabins, and thoughtful family-oriented features like rear-seat entertainment systems, sunshades, and storage solutions. The Li Auto L9, for instance, feels purpose-built for family life in ways Tesla’s vehicles don’t.

The most important insight: “Chinese EVs” aren’t a monolithic alternative to Tesla—they’re diverse products from companies at different stages of development, competing on different strengths. A BYD Seal offers completely different value than a NIO ET5, just as a Model 3 differs from a Model X.

Making Your Decision

Make your decision based on careful evaluation of your specific use case, not brand loyalty or assumptions. Test drive both Tesla and relevant Chinese alternatives. Verify local charging infrastructure through PlugShare or similar services to understand real-world charging availability in your area. Confirm service center proximity—this matters more than most buyers initially realize. Calculate total cost of ownership honestly using tools like the EV comparison calculator from the Department of Energy.

Research owner forums and communities for both Tesla and Chinese brands. Real-world ownership experiences reveal insights that marketing materials and reviews often miss. Pay particular attention to posts from owners in your geographic region dealing with your climate conditions.

The Broader Market Evolution

The EV market has matured past the point where one brand dominates every category. That’s excellent news for buyers—competition drives innovation, improves quality, and reduces prices. Traditional automakers like Volkswagen, BMW, and Hyundai also compete aggressively, adding further options to an increasingly diverse marketplace.

Whether you choose Tesla, BYD, NIO, or another option entirely, you’re buying into a cleaner, technologically sophisticated future. The environmental benefits of electric mobility apply regardless of manufacturer. The question isn’t simply whether Chinese EVs are as good as Tesla—it’s which specific vehicle best matches your specific needs in 2026 and beyond.

Understanding the Bigger Picture

This comparison extends beyond individual purchase decisions. The rise of Chinese EV manufacturers represents a fundamental shift in global automotive power. For decades, innovation flowed primarily from Western and Japanese automakers. Now, Chinese companies drive battery technology advancement, manufacturing efficiency improvements, and aggressive pricing that benefits consumers worldwide.

Tesla deserves credit for catalyzing this transformation. Without Tesla proving EVs could be desirable, profitable, and technologically superior, the current competitive landscape wouldn’t exist. However, competition has arrived, and it’s formidable. That reality serves consumers exceptionally well.

Final Verdict on Chinese EVs vs Tesla

So, returning to our central question: are Chinese EVs as good as Tesla? The answer is definitively nuanced—yes in many ways, not yet in others, and sometimes better depending on your priorities.

Chinese EVs match or exceed Tesla in interior luxury, price-to-value ratios, battery safety, and hardware innovation speed. Tesla maintains advantages in software maturity, charging infrastructure (particularly in North America), established service networks, and proven long-term reliability data.

The right choice emerges from honest self-assessment: What matters most to you? Where do you live? How do you drive? What’s your budget? Answer these questions clearly, and the correct vehicle—whether Tesla, Chinese, or another option—becomes obvious.

Ready to make your decision? Start by identifying your non-negotiables—maximum range, software features, interior luxury, price ceiling, or charging infrastructure access. Then shortlist vehicles that meet those criteria and test drive them. The right EV for you exists in this increasingly competitive market, and understanding whether Chinese EVs are as good as Tesla for your unique situation will lead you to the perfect choice. Don’t let brand perception or outdated assumptions guide a decision worth tens of thousands of dollars. Drive the vehicles, evaluate the facts, and choose based on what genuinely serves your needs best.