What “Cheapest EV Car in China” Really Means

When someone searches for the cheapest EV car in China, they’re not just looking for a number. Instead, they’re trying to understand how a country can produce electric vehicles that cost less than a used motorcycle in some markets—and whether these vehicles represent genuine transportation or compromised safety.

China’s EV revolution has rewritten global automotive economics. While Western automakers struggle to produce electric vehicles under $35,000, Chinese manufacturers are selling functional EVs for under $5,000. This isn’t a future prediction—it’s happening now, and the 2026 model year promises to push affordability even further.

The Wuling Hongguang Mini EV stands as the symbol of this disruption. Since its 2020 launch, it has outsold Tesla’s Model 3 in China multiple times, proving that millions of buyers prioritize access over aspiration. This article examines what the cheapest EV car in China actually costs in 2026, what buyers receive for that price, and the industrial factors that make such pricing possible.

You’ll learn the real delivered price after subsidies, the specification trade-offs that enable rock-bottom pricing, and whether these ultra-budget EVs make sense for anyone beyond urban Chinese commuters.

How China Became the World’s Cheapest EV Factory

Government Subsidies Shaped the Industry

China didn’t accidentally become the cheapest EV producer. Three structural advantages created this outcome, beginning with government policy that shaped an entire industry. Between 2009 and 2022, China invested over $60 billion in EV subsidies and infrastructure according to research from the International Energy Agency. Cities offered free license plates for EVs while restricting gasoline vehicle registrations. Local governments provided land and tax breaks to EV manufacturers. This wasn’t subtle market intervention—it was industrial planning executed at national scale.

Supply Chain Dominance Drives Costs Down

Second, China controls the battery supply chain. The country produces around 77% of the world’s lithium-ion battery cells and refines nearly 90% of the rare earth elements used in EV motors. As a result, when a Chinese automaker builds an electric vehicle, almost every critical component is sourced within a 500-kilometer radius. That proximity removes import duties, minimizes currency-exchange exposure, and avoids costly transcontinental shipping. The outcome is deep vertical integration that strips out expenses Western automakers simply cannot escape.

Competition Forces Ruthless Efficiency

Third, competition drives ruthless efficiency. Over 300 EV brands have launched in China since 2015, though most will fail. This Darwinian pressure forces surviving manufacturers to optimize every aspect of production. Assembly line workers earn $800 monthly compared to $4,500 in Germany. Suppliers compete for contracts with margins measured in single-digit percentages. The result is an automotive ecosystem where a $500 cost reduction matters more than brand prestige.

These three factors—strategic subsidies, supply chain dominance, and cutthroat competition—explain why China can produce the cheapest EV car in the world. They also explain why replicating this model elsewhere remains nearly impossible.

Defining “Cheapest EV Car in China 2026”

Identifying the cheapest EV car in China requires clear criteria. Pricing alone doesn’t tell the complete story.

For this analysis, a qualifying vehicle must offer a manufacturer’s suggested retail price below ¥50,000 (approximately $7,000 USD), include a functional battery warranty, and be available for general consumer purchase—not limited to fleet sales or regional pilot programs. The vehicle must seat at least two occupants and meet China’s national EV safety standards for road use.

Understanding Chinese EV Pricing Structure

Pricing in China follows a complex structure. The base MSRP represents the starting point, but most buyers pay significantly less after applying national EV purchase tax exemptions and regional subsidies. In cities like Shanghai or Shenzhen, these incentives can reduce the effective price by 15-20%. Rural buyers often pay closer to the advertised MSRP.

Currency conversion adds another layer of complexity. The exchange rate between Chinese yuan and US dollars fluctuates, but for 2026 projections, ¥7 to $1 USD provides a reasonable baseline. However, direct price comparisons mislead because Chinese domestic pricing reflects local purchasing power and government incentives that don’t exist in export markets.

The cheapest EV car in China won’t necessarily be the cheapest EV globally. Export versions typically cost 30-50% more due to shipping, import duties, safety certification, and dealership margins. A ¥30,000 EV in Guangzhou might retail for €12,000 in Europe—still affordable by Western standards, but no longer shockingly cheap.

The Cheapest EV Car in China (2026): Model Reveal

Spotlight: Wuling Hongguang Mini EV — 2026’s Most Affordable Electric Vehicle

The Wuling Hongguang Mini EV remains the undisputed champion of affordable electric mobility entering 2026. As the cheapest EV car in China, the base model carries an MSRP of approximately ¥32,800 ($4,685 USD), positioning it as the most affordable option for the sixth consecutive year.

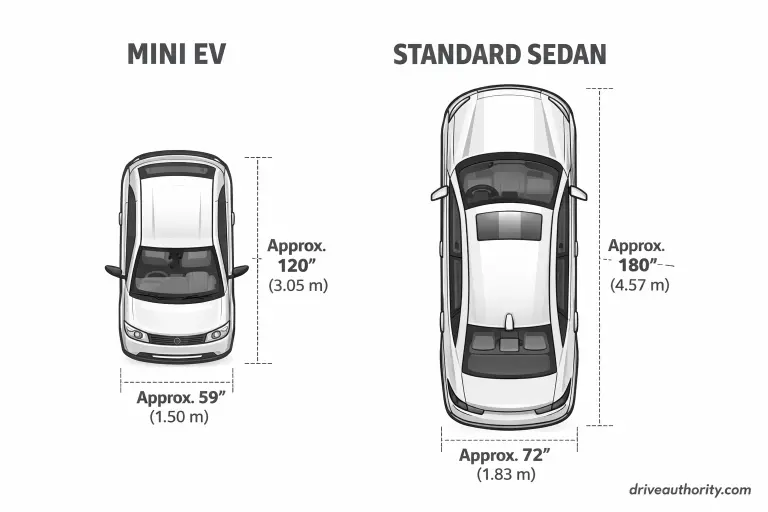

This isn’t a concept vehicle or limited production run. SAIC-GM-Wuling manufactures over 400,000 units annually across three factories. The 2026 model continues the proven formula: a compact two-door city car with seating for four, a lithium iron phosphate battery, and just enough range for daily urban commuting.

Real Purchase Price After Incentives

After applying China’s national EV purchase tax exemption and typical municipal incentives available in tier-one cities, buyers pay approximately ¥28,500 ($4,070 USD) out of pocket. In smaller cities with additional local subsidies, the delivered price can drop to ¥26,000 ($3,715 USD). No other highway-legal electric vehicle anywhere in the world approaches this price point.

The 2026 Hongguang Mini EV offers three trim levels. The base Qingchun edition provides 120 kilometers of CLTC-rated range. Meanwhile, the mid-tier Meili edition extends range to 170 kilometers and adds air conditioning as standard equipment. The top Macaron edition reaches 200 kilometers and includes a basic touchscreen infotainment system. Even the fully-loaded Macaron variant costs just ¥43,600 ($6,230 USD) before incentives.

Wuling deliberately positions this vehicle as urban transportation, not a lifestyle product. There’s no pretense about competing with Tesla or BYD’s premium offerings. The Hongguang Mini EV exists to move people affordably in congested cities where 95% of daily trips cover less than 50 kilometers. For that specific use case, it succeeds completely.

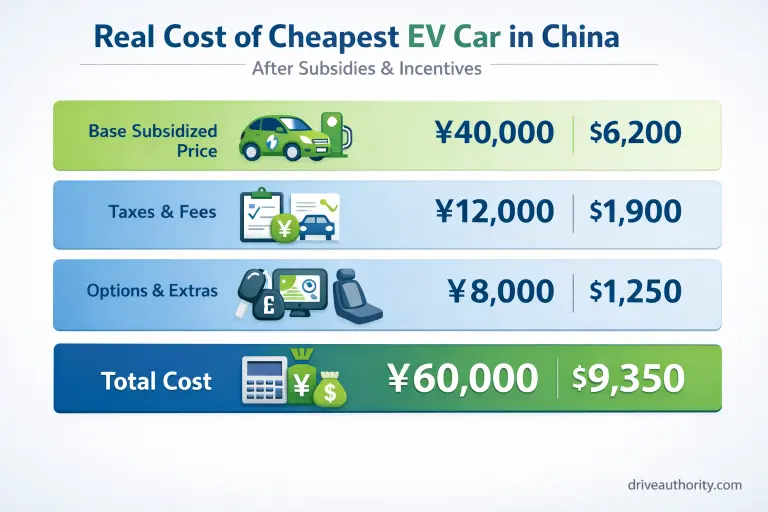

Price Breakdown: What You Actually Pay for the Cheapest EV in China

Understanding the true cost of the cheapest EV car in China requires looking beyond the sticker price. Chinese EV pricing operates on a three-tier structure that varies significantly by location.

Base MSRP vs Real Purchase Price

The base MSRP for the 2026 Wuling Hongguang Mini EV starts at ¥32,800. However, this represents the manufacturer’s listed retail price before any government intervention, and virtually no buyer pays this amount.

China’s national EV purchase tax exemption immediately reduces the cost by approximately ¥2,800-3,200 depending on the vehicle’s specifications. This isn’t a rebate—buyers simply don’t pay the 10% purchase tax that applies to gasoline vehicles. The exemption remains in effect through 2027 as part of China’s carbon reduction commitments outlined by China’s Ministry of Industry and Information Technology.

Municipal Incentives Add Significant Savings

Municipal and provincial incentives add another layer of savings. In Shanghai, EV buyers receive a free license plate valued at ¥90,000 ($12,850 USD) if purchased separately. While this doesn’t reduce the vehicle’s cash price, it represents enormous practical savings. Shenzhen offers direct cash subsidies of ¥3,000-5,000 for ultra-low-cost EVs. Beijing provides preferential parking rates and exemption from traffic restrictions. Guangzhou adds insurance subsidies for first-time EV buyers.

Regional Pricing for China’s Cheapest Electric Car

Regional pricing disparities matter significantly. In tier-one coastal cities where EV adoption is highest, the delivered price for a base Hongguang Mini EV typically settles around ¥28,500 after all incentives. In tier-three inland cities with lower demand, prices may drop to ¥26,000 as dealers and local governments add promotional discounts. Rural buyers in provinces with minimal EV infrastructure often pay closer to the ¥31,000 mark after limited subsidies.

Registration fees, mandatory insurance, and first-year maintenance contracts add approximately ¥2,500-3,500 to the total out-of-pocket cost. When calculating affordability, Chinese buyers consider this “on-road” price as the true acquisition cost. For the cheapest EV car in China, that figure ranges from ¥29,000 to ¥34,500 ($4,140-4,930 USD) depending on location and negotiation.

Specs That Matter: What Do You Get for So Little?

Battery & Range in China’s Most Affordable EV

The 2026 Wuling Hongguang Mini EV base model uses a 13.9 kWh lithium iron phosphate (LFP) battery manufactured by domestic supplier Guoxuan High-Tech. This chemistry prioritizes safety and cost over energy density. The battery pack weighs 110 kilograms and sits beneath the floor, lowering the center of gravity despite the vehicle’s tall, boxy proportions.

Official CLTC range reaches 120 kilometers for the base trim. CLTC testing—China’s optimistic standard—measures range under ideal conditions that rarely reflect real-world driving. Expect approximately 90-100 kilometers in mixed city driving during temperate weather. Cold weather below 0°C reduces usable range to 70-80 kilometers as the battery management system limits power output to protect cell longevity.

The mid-tier model increases capacity to 20 kWh, delivering 170 kilometers CLTC or roughly 130 kilometers in real-world conditions. The top Macaron trim carries a 26.5 kWh pack rated for 200 kilometers CLTC—about 150-160 kilometers practically. None of these configurations suit highway driving or intercity travel. Instead, the Hongguang Mini EV is optimized for 15-25 kilometer daily commutes with charging every 3-4 days.

Battery warranty coverage spans eight years or 120,000 kilometers, whichever arrives first. Wuling guarantees the battery will retain at least 70% of original capacity during this period. Early owner data from 2020-2023 models suggests degradation averages 8-12% after three years of urban use—acceptable given the vehicle’s purchase price and expected lifespan.

Power & Performance

A single permanent magnet synchronous motor mounted at the rear axle produces 20 kW (27 horsepower) in the base model. Higher trims increase output to 30 kW (40 horsepower). These figures sound absurdly low compared to conventional vehicles, yet the immediate torque delivery of electric motors and the car’s 705-kilogram curb weight create surprisingly adequate acceleration for city driving.

Zero to 50 km/h acceleration takes approximately 6.5 seconds—quick enough to merge into urban traffic safely. Top speed is electronically limited to 100 km/h for the base model and 105 km/h for higher trims. These limits reflect both safety considerations and range optimization. At maximum speed, the Hongguang Mini EV drains its battery in roughly 45 minutes.

The vehicle feels most comfortable between 30-60 km/h where it operates efficiently and quietly. Highway driving is legal but unpleasant. Wind noise becomes intrusive above 80 km/h, and the narrow 145-width tires generate noticeable road roar on coarse pavement. This isn’t a vehicle designed for the expressway—it’s engineered for congested city centers where average speeds rarely exceed 35 km/h.

Charging Capabilities

The cheapest EV car in China uses a simplified charging system that eliminates expensive fast-charging hardware. The base Hongguang Mini EV includes only AC charging capability through a standard household electrical outlet.

Using the included portable charger and a 220V outlet, the 13.9 kWh battery fully recharges in approximately 6.5 hours. The 20 kWh mid-tier battery requires 9 hours. The largest 26.5 kWh pack needs 12 hours for a complete charge. These durations align perfectly with overnight home charging—the intended use case.

Higher trims offer an optional onboard charger upgrade that accepts up to 6.6 kW from dedicated wall-mounted charging stations, reducing charge times to 2-3.5 hours depending on battery size. However, DC fast charging remains unavailable across all trim levels. The vehicle cannot use highway fast-charging networks operated by State Grid or private providers.

This limitation matters less than it appears. Owners who need DC fast charging have fundamentally misunderstood the vehicle’s purpose. The Hongguang Mini EV serves urban dwellers with access to home or workplace charging. For this population, overnight AC charging provides sufficient energy for daily needs at minimal cost—approximately ¥0.50-0.70 per kWh during off-peak residential rates.

Interior & Features

The interior of the cheapest EV car in China reflects ruthless cost optimization. Hard plastic covers every surface. The steering wheel lacks telescoping adjustment. Seats use basic foam padding with cloth upholstery. There’s no center console—just an open space between the front seats for storing phones or drinks.

The base model omits air conditioning entirely. A small electric fan provides minimal cooling. This specification shocks Western buyers but makes sense in price-conscious markets where air conditioning adds ¥2,000 to the purchase price and reduces range by 15-20% when operating.

Mid and upper trims include manual air conditioning, power windows, and a small digital instrument cluster displaying speed, range, and battery status. The Macaron edition adds an 8-inch touchscreen running a basic infotainment system with Bluetooth connectivity and smartphone mirroring. Navigation relies on your phone—there’s no integrated GPS system.

Safety equipment meets Chinese regulatory minimums. Dual front airbags come standard. ABS braking is included. However, electronic stability control, blind spot monitoring, and collision warning systems remain absent. This is passive safety engineering: crumple zones and restraint systems without active intervention technology.

The rear seats fold flat to expand cargo space from 285 liters to 741 liters—surprisingly practical for a vehicle measuring just 2,920mm in length. Four adults fit uncomfortably for short trips. Two adults and two children work reasonably well for daily school runs or grocery shopping.

Why It’s So Cheap: Engineering & Production Factors

Simplified Platform Engineering

SAIC-GM-Wuling designed the Hongguang Mini EV on a dedicated ultra-low-cost platform that shares nothing with conventional vehicles. This ground-up approach allowed engineers to eliminate every non-essential component.

The chassis uses a simplified MacPherson strut front suspension and a De Dion rear axle—technology dating to the 1890s but reliable and inexpensive to manufacture. There’s no multi-link suspension, no adaptive dampers, no sub-frame isolation. The steering system employs mechanical linkage without electronic power assistance in base models. These choices reduce complexity, part count, and assembly time.

The vehicle’s boxy shape maximizes interior space while minimizing manufacturing complexity. Flat body panels require simpler stamping dies. Right angles reduce welding time. Overall, the design prioritizes function and production efficiency over aesthetics or aerodynamics. Wind resistance at highway speeds suffers, but highway driving wasn’t the design objective.

Battery Chemistry Choices in the Cheapest EV Car in China

The Hongguang Mini EV exclusively uses lithium iron phosphate (LFP) chemistry, which costs approximately 30-40% less than nickel-cobalt-manganese (NCM) batteries used in premium EVs. LFP batteries offer superior thermal stability, longer cycle life, and eliminate dependence on expensive cobalt.

The trade-off comes in energy density. LFP stores about 20% less energy per kilogram than NCM chemistry. For a vehicle prioritizing low cost over long range, this trade-off makes perfect economic sense. Additionally, the safety advantages of LFP chemistry reduce insurance costs and liability risk—meaningful factors at volume production scales.

Local Parts Sourcing and Vertical Integration

Approximately 95% of components in the cheapest EV car in China come from suppliers within 300 kilometers of the assembly plant. The electric motor is manufactured in-house by SAIC. Battery cells come from Guoxuan High-Tech facilities in nearby Hefei. Tires are supplied by Wanli, a local brand. Interior plastics are injection-molded at a facility adjacent to the main assembly line.

This geographic clustering eliminates logistics costs and enables just-in-time delivery. Parts arrive at the factory within hours of production, reducing inventory carrying costs. When component prices drop, savings flow immediately to the final product. According to analysis from BloombergNEF, this supply chain efficiency contributes an estimated 15-20% cost advantage compared to Western automotive production models.

Government Policy and EV Incentives

Chinese government support extends beyond consumer subsidies. EV manufacturers receive preferential access to industrial land, reduced corporate tax rates, and direct financial support for R&D activities. Local governments compete to attract EV factories, offering infrastructure improvements and workforce training programs at no cost to manufacturers.

These production-side incentives don’t appear on consumer invoices, but they fundamentally alter the economics of EV manufacturing. A Western automaker building an identical vehicle would face higher land costs, standard corporate tax rates, and self-funded workforce development. The cumulative effect adds thousands of dollars to unit costs before the first vehicle rolls off the assembly line.

Safety & Reliability: What Budget EVs Sacrifice

Crash Test Ratings for China’s Cheapest Electric Car

The cheapest EV car in China meets mandatory Chinese safety standards, but those standards differ significantly from European or American requirements.

The 2024 Hongguang Mini EV received a three-star rating from China’s C-NCAP crash testing program—adequate but not exceptional. The vehicle’s structure performed acceptably in frontal and side impacts, with the crumple zones absorbing energy as designed. However, the lack of electronic stability control and the minimal crush space in such a compact vehicle raise concerns for high-speed collisions.

European safety regulators have not tested the Hongguang Mini EV, and it likely would not pass Euro NCAP testing without significant structural modifications. The absent side-curtain airbags, lack of pedestrian protection systems, and omitted advanced driver assistance features would result in a poor rating by Western standards.

Real-World Reliability Data

Reliability data from four years of sales suggests the Hongguang Mini EV performs reasonably well for its price point. Common issues include faulty door latches, occasional battery management system software glitches requiring updates, and premature wear of brake components. Nevertheless, catastrophic failures remain rare. The vehicle’s mechanical simplicity works in its favor—there are fewer systems to malfunction.

Battery fire incidents have occurred but at rates comparable to or lower than the broader EV market. LFP chemistry’s thermal stability provides meaningful safety advantages. No recalls related to battery fire risk have been issued for 2022-2024 models.

The vehicle’s reliability must be contextualized against its purchase price. A ¥30,000 EV will never match the build quality or longevity of a ¥200,000 vehicle. Buyers should expect a 5-8 year functional lifespan with basic maintenance, after which repair costs may exceed the vehicle’s residual value.

Ownership Costs: Is the Cheapest EV Car in China Truly Affordable Over Time?

Energy Costs

Electricity costs in China average ¥0.50-0.70 per kWh for residential users during off-peak hours. Charging the Hongguang Mini EV’s 20 kWh battery costs approximately ¥10-14 ($1.40-2.00 USD), providing 130-150 kilometers of real-world range. Consequently, this translates to roughly ¥0.07-0.10 per kilometer ($0.01-0.014 per km).

A comparable gasoline vehicle achieving 6 liters per 100 kilometers at current fuel prices of ¥7.50 per liter costs ¥0.45 per kilometer—more than four times the Hongguang Mini EV’s energy cost. Over 15,000 kilometers of annual driving, the EV saves approximately ¥5,100 ($730 USD) compared to gasoline.

Insurance Cost in China

Mandatory third-party liability insurance for the Hongguang Mini EV costs approximately ¥600-800 annually due to its low vehicle value. Comprehensive coverage including collision and theft adds another ¥800-1,200, bringing total annual insurance costs to ¥1,400-2,000 ($200-285 USD).

Higher-priced EVs like the BYD Han or Tesla Model 3 carry insurance costs of ¥5,000-8,000 annually. Therefore, the cheapest EV car in China delivers meaningful insurance savings that compound over the ownership period.

Servicing & Parts

The Hongguang Mini EV requires minimal maintenance. There’s no engine oil to change, no transmission fluid to service, no spark plugs to replace. Scheduled maintenance consists primarily of tire rotations, brake inspections, and battery system diagnostics.

Annual maintenance costs typically range from ¥300-600 ($43-86 USD) for routine inspections and minor consumables. Brake pads last longer than gasoline vehicles due to regenerative braking. Tires wear normally and cost approximately ¥400-600 for a complete set of replacements.

Major component failures outside warranty can be expensive relative to vehicle value. A replacement battery pack costs ¥15,000-20,000—more than half the vehicle’s original purchase price. Motor failures cost ¥5,000-8,000 to repair. These risks explain why many owners treat the vehicle as semi-disposable, planning to replace rather than extensively repair it after warranty expiration.

Competitor Comparison: Other Ultra-Low-Cost EVs in China

| Model | Price (CNY) | Range (CLTC) | Key Features | Comments |

|---|---|---|---|---|

| Wuling Hongguang Mini EV | ¥32,800 | 120-200 km | Basic safety, LFP battery, proven reliability | Market leader, highest volume |

| Chery QQ Ice Cream | ¥35,900 | 120-170 km | Slightly better interior, similar specs | Close competitor, less brand recognition |

| Changan Lumin | ¥45,900 | 155-210 km | Improved styling, better features | Mid-budget pick, targets younger buyers |

| Geely Panda Mini | ¥39,900 | 120-200 km | Geely brand prestige, similar platform | Marginally better quality perception |

| BYD Seagull | ¥73,800 | 305-405 km | Significantly longer range, modern tech | Too expensive to qualify as “cheapest” |

The Wuling Hongguang Mini EV maintains its price leadership through scale advantages and brand acceptance. Chery’s QQ Ice Cream offers comparable value but lacks Wuling’s production volume and dealer network density. Meanwhile, Changan Lumin targets style-conscious buyers willing to pay a premium for improved aesthetics.

The BYD Seagull represents the price cliff that occurs when manufacturers add meaningful range and features. At nearly 2.5 times the Hongguang Mini EV’s price, it delivers substantially better specifications but exits the ultra-budget category entirely. This comparison clarifies that the cheapest EV car in China achieves its pricing through deliberate limitation rather than across-the-board cost reduction.

Buyer Profiles: Who Should Consider the Cheapest EV in China

Urban Commuters

The ideal buyer lives in a Chinese city with dedicated parking and consistent access to home charging. Daily commutes cover 15-30 kilometers each way. Weekend driving rarely exceeds the vehicle’s range. This owner already commutes by electric scooter or public transit and views the Hongguang Mini EV as weather protection and cargo capacity—not transportation revolution.

For this specific use case, the cheapest EV car in China represents genuinely excellent value. The low purchase price, minimal operating costs, and adequate functionality align perfectly with actual needs. Buyers in tier-two and tier-three cities where traffic congestion is severe but incomes remain modest find this vehicle particularly compelling.

Young Professionals and Budget Buyers

First-time car buyers in expensive coastal cities increasingly choose ultra-low-cost EVs as starter vehicles. The combination of free license plates in cities like Shanghai and low operating costs makes ownership financially viable for younger professionals earning ¥6,000-10,000 monthly.

These buyers prioritize access over aspiration. They’re not measuring the Hongguang Mini EV against premium vehicles—they’re comparing it to continued reliance on ride-hailing services or expensive monthly metro passes. The psychological value of personal mobility, even in a basic vehicle, justifies the modest investment.

Not for Long Highway Trips

Anyone planning regular intercity travel or highway driving should avoid the cheapest EV car in China. The limited range, absence of fast charging, low top speed, and minimal safety features make highway use impractical and potentially unsafe.

Rural buyers without home charging access will struggle with the vehicle’s limitations. The sparse public charging infrastructure in less developed regions creates range anxiety that undermines the ownership experience. Similarly, families requiring more than two adult seats regularly or cargo space beyond grocery shopping will quickly outgrow the vehicle’s capabilities.

Future Outlook: Will the Cheapest EV in China Get Even More Affordable?

Battery costs continue declining at approximately 8-10% annually. As cell manufacturing scales and chemistry improvements increase energy density, the marginal cost of producing small-capacity battery packs will decrease further. By 2027-2028, the battery pack in vehicles like the Hongguang Mini EV may cost manufacturers ¥3,000-4,000 less than current prices.

New entrants targeting the ultra-budget segment will intensify price competition. Brands like Leapmotor, Neta, and regional manufacturers in provinces like Shandong are developing competing models with target pricing below ¥30,000. Some analysts project that by 2028, functional EVs with 150+ kilometers of range could reach ¥25,000 MSRP before subsidies.

However, pricing cannot drop indefinitely. Material costs for steel, aluminum, plastics, and electronic components establish a floor below which profitable production becomes impossible. Even with aggressive automation and scale, manufacturing a highway-legal electric vehicle for under ¥20,000 presents enormous challenges.

The more likely outcome involves stable pricing around current levels with gradually improving specifications. Instead of cheaper vehicles, consumers will receive more range, better features, and improved quality for similar prices. The 2028 cheapest EV car in China might still cost ¥30,000-35,000, but it could offer 250 kilometers of range, basic ADAS features, and improved interior materials—representing better value rather than lower absolute cost.

Conclusion: What the Cheapest EV Car in China Tells Us

The Wuling Hongguang Mini EV: Cost Above All Else

The Wuling Hongguang Mini EV, priced from ¥32,800 ($4,685 USD) before incentives, remains the cheapest EV car in China entering 2026. Its success does not come from cutting-edge technology or premium features. Instead, it reflects ruthless cost optimization, deep vertical supply-chain integration, and government policies designed to accelerate EV adoption at scale.

This is transportation engineering reduced to its essentials.

Designed for Urban Reality, Not Aspirations

There is no luxury here. Comfort is minimal, performance is limited, and capability rarely extends beyond dense urban environments. Yet for millions of Chinese buyers, those compromises matter far less than the core value proposition: affordable personal mobility with extremely low operating costs.

In crowded cities with short daily trips and scarce parking, aspiration takes a back seat to practicality.

Deliberate Trade-Offs in Specifications

The specifications reveal intentional restraint rather than technical weakness. A 120–200 kilometer CLTC range covers daily city use while removing the cost burden of long-distance capability. A simplified interior and the absence of advanced driver-assistance systems lower the purchase price but reduce comfort and protection.

Meanwhile, LFP battery chemistry prioritizes safety, durability, and cost over energy density. Each engineering decision reinforces a single objective: affordability.

Ownership Economics That Actually Work

Running costs validate the logic. Energy expenses of ¥0.07–0.10 per kilometer, insurance costs below ¥2,000 annually, and minimal maintenance requirements create a compelling total cost of ownership for urban users.

However, these advantages come with clear constraints. The lack of fast charging, limited highway performance, and basic safety equipment narrow the vehicle’s appeal to very specific use cases. This is not a universal solution—it is a targeted one.

Lessons for the Global EV Market

The cheapest EV car in China succeeds because it aligns with what budget buyers truly need, not what automotive marketing traditionally promotes. It is not aspirational transportation. It is functional, affordable mobility designed for cities where distances are short and costs matter more than brand prestige.

For Western observers, the Hongguang Mini EV challenges the assumption that electric vehicles must be premium products. Affordable EVs become viable when manufacturers accept range limits, simplify specifications, and prioritize access over performance. Whether this model can translate to markets with different geography, infrastructure, and consumer expectations remains uncertain. Still, in Chinese cities—where over 60% of daily trips are under 20 kilometers—the cheapest EV car in China represents technology that is not just affordable, but genuinely appropriate.

The Wuling Hongguang Mini EV, priced from ¥32,800 ($4,685 USD) before incentives, remains the cheapest EV car in China entering 2026. Its success stems not from technological breakthrough but from ruthless optimization, vertical supply chain integration, and government policies designed to accelerate EV adoption.

This vehicle represents transportation engineering stripped to essentials. There’s no luxury, minimal comfort, and limited capability beyond urban commuting. Yet for millions of Chinese buyers, these limitations matter less than the fundamental value proposition: affordable personal mobility with near-zero operating costs.

Frequently Asked Questions

How much does the cheapest EV car in China actually cost after subsidies?

The 2026 Wuling Hongguang Mini EV costs approximately ¥28,500-31,000 ($4,070-4,430 USD) after national purchase tax exemptions and typical municipal incentives in major cities. Rural areas with fewer incentives may see prices closer to ¥32,000. These figures include the base purchase price but exclude registration fees and insurance.

Can I buy the cheapest Chinese EV in other countries?

Export versions of ultra-low-cost Chinese EVs typically cost 30-50% more than domestic pricing due to shipping, import duties, safety certifications, and regulatory compliance. The Hongguang Mini EV is available in some European markets under different branding, priced around €10,000-12,000—still affordable but no longer the cheapest option globally.

Is the Wuling Hongguang Mini EV safe to drive?

The vehicle meets Chinese national safety standards and received a three-star C-NCAP rating. It includes dual front airbags and ABS braking but lacks advanced safety features like stability control or collision warning. The compact size and limited crash structure make it less safe than larger vehicles in high-speed collisions, though it performs adequately for low-speed urban driving.

What is the real-world range of the cheapest EV car in China?

Real-world range for the base Wuling Hongguang Mini EV is approximately 90-100 kilometers in temperate weather, compared to the 120-kilometer CLTC rating. Cold weather below 0°C reduces range to 70-80 kilometers. Higher trim levels with larger batteries achieve 130-160 kilometers in typical conditions. Highway driving at maximum speed depletes the battery in roughly 45 minutes.

How long does it take to charge the cheapest Chinese EV?

Using the included 220V portable charger, the base 13.9 kWh battery requires 6.5 hours for a full charge. Larger battery options take 9-12 hours. Optional upgraded onboard chargers reduce this to 2-3.5 hours with dedicated wall-mounted charging equipment. DC fast charging is not available on any trim level.

What are common problems with ultra-cheap Chinese EVs?

Owner-reported issues include faulty door latches, occasional battery management software glitches requiring updates, premature brake component wear, and basic build quality concerns like interior panel gaps. However, catastrophic failures remain rare. The vehicle’s mechanical simplicity results in fewer potential failure points compared to more complex EVs.

Why are Chinese EVs so much cheaper than Western electric vehicles?

Chinese manufacturers benefit from vertical supply chain integration, government subsidies and production incentives, lower labor costs, and ruthless cost optimization. Approximately 95% of components are sourced locally, eliminating import costs. LFP battery chemistry costs 30-40% less than nickel-based alternatives. Simplified platform engineering and high production volumes further reduce unit costs.

Does the cheapest EV in China make sense for non-urban buyers?

No. The vehicle’s limited range, lack of fast charging, and reliance on home charging make it impractical for rural areas or regions with sparse charging infrastructure. It’s specifically designed for urban environments where daily driving distances are short, traffic speeds are low, and overnight home charging is available.