Fast Decision: Should You Buy a Chinese Electric Car?

Chinese electric cars like the BYD Atto 3 and MG4 EV cost $10,000–$15,000 less than comparable Teslas while offering similar range and more standard features—but you’re trading proven reliability and strong resale value for upfront savings. If you’re a first-time EV buyer planning to keep the car 3–5 years with home charging access and a nearby dealership, Chinese EVs deliver unmatched value. If you need a vehicle that holds equity or plan to keep it 10+ years, stick with Tesla, Hyundai, or Kia.

Buy if: You prioritize cost per feature, live near a dealer, and plan to trade in within 5 years.

Wait if: You’re in a rural area with no service network or want proven 200,000-mile durability data.

Avoid if: Resale value matters more than upfront savings, or you need mature software ecosystems.

This guide targets value-conscious buyers researching their first or second EV—not luxury shoppers or tech enthusiasts chasing cutting-edge autonomy.

What Are Chinese Electric Cars? (And Why They’re Disrupting the Market)

Chinese electric cars are EVs designed, engineered, and manufactured by automakers headquartered in China—including BYD, NIO, XPeng, MG (SAIC), and Geely. These aren’t rebadged global models; they’re purpose-built EVs leveraging China’s dominance in battery production and supply chain integration.

Why this matters: China controls over 75% of global lithium-ion battery production and 60% of EV assembly. This vertical integration—from lithium refining to finished vehicles—enables Chinese automakers to undercut Western brands by 25–35% while maintaining competitive specs. When BYD makes its own battery cells, motors, and semiconductors in-house, it eliminates the 20–30% markup that Tesla pays to Panasonic or LG.

Real-world impact: A BYD Seal with 330 miles of range costs $42,000 in Europe. A Tesla Model 3 Long Range with similar specs? $52,000+. That $10,000 gap funds 3–4 years of home charging.

Why Chinese Electric Cars Are So Affordable (The Battery Economics)

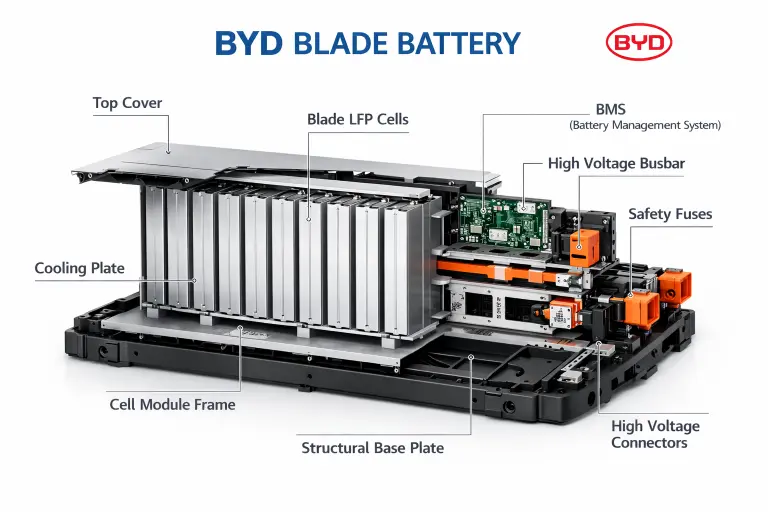

Chinese EV Battery Cost Advantage

BYD’s Blade Battery (LFP chemistry) costs roughly $70 per kWh to produce—compared to $110–$130 per kWh for NMC batteries from Western suppliers, according to BloombergNEF’s 2024 battery price survey. On a 60 kWh pack, that’s $3,600–$4,800 in raw savings before assembly.

What you’re trading: LFP batteries charge slower above 80% and offer 10–15% less energy density than NMC packs. In practice, this means your 250-mile Chinese EV might add only 60 miles in 20 minutes at a fast charger, versus 80 miles for a Tesla. For daily commutes under 150 miles with home charging, this rarely matters. For road-trippers without charging patience, it’s friction.

Government Subsidies and Scale Production

China’s EV subsidies exceed $30 billion since 2015, funding R&D, export incentives, and factory expansion. This lets BYD sell the Dolphin hatchback at break-even while building brand recognition—a playbook Tesla used in the U.S. from 2008–2015. Western buyers benefit from this price war without paying Chinese taxes.

The catch: If subsidies end or tariffs increase (currently 10% in the EU, 27.5% in the U.S.), prices could rise 15–20% overnight. Lock in current pricing if you’re buying in 2025.

Chinese Electric Car Prices by Segment (2025 Global Ranges)

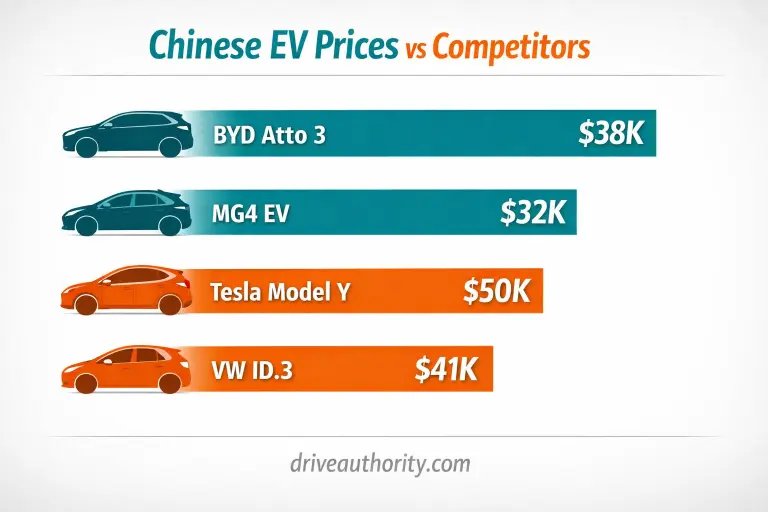

| Category | Chinese EV Example | Price | Non-Chinese Competitor | Price | Savings |

|---|---|---|---|---|---|

| Entry Hatchback | BYD Dolphin | $28,000 | Nissan Leaf | $29,000 | $1,000 |

| Compact SUV | BYD Atto 3 | $38,000 | Tesla Model Y (RWD) | $50,000 | $12,000 |

| Mid-Range Sedan | MG4 EV | $32,000 | VW ID.3 | $41,000 | $9,000 |

| Premium Sedan | NIO ET5 | $58,000 | BMW i4 eDrive40 | $62,000 | $4,000 |

| Long-Range SUV | BYD Seal U | $45,000 | Hyundai Ioniq 5 | $48,000 | $3,000 |

Pricing reality check: These are manufacturer suggested retail prices in Europe and Australia as of January 2025. U.S. buyers face 27.5% tariffs, pushing Chinese EV prices into non-competitive territory ($38,000 becomes $48,000+). If you’re in North America, this guide applies only if tariffs drop or you’re importing used models.

Major Chinese Electric Car Brands You Need to Know

BYD: The Battery-to-Vehicle Giant

BYD (Build Your Dreams) is the world’s largest EV maker, selling 3+ million EVs in 2024. Their Blade Battery uses LFP chemistry, which resists thermal runaway better than NMC packs—critical for safety in extreme heat. The Atto 3 and Seal dominate exports.

Who it’s for: Budget-conscious families wanting Toyota-like build quality at Kia pricing.

MG (Owned by China’s SAIC Motor)

MG targets export markets with the MG4 EV and ZS EV—affordable, practical crossovers priced 20–25% below European rivals. Build quality is solid but not premium; think Mazda CX-5 interior at Hyundai Venue prices.

Service reality: MG dealers exist in major cities across the UK, Europe, and Australia. In rural Scotland or outback Australia, parts can take 3–6 weeks. Ask your local dealer about loaner vehicle policies before buying.

NIO: Chinese Electric Cars Targeting Luxury Buyers

NIO competes with BMW and Mercedes at $55,000–$75,000, offering battery-swap technology (exchange a depleted battery in 5 minutes). This works in China with 2,000+ swap stations; outside China, only 50 stations exist as of 2025.

Bottom line: Skip NIO unless you live within 30 miles of a swap station or don’t mind traditional DC fast charging.

XPeng: Software-First Chinese EVs

XPeng emphasizes autonomous driving and OTA updates. Their ADAS (XNGP) handles city driving better than most competitors but still lags Tesla’s FSD by 1–2 years in edge-case handling.

Real talk: If you want cutting-edge software, buy a Tesla. If you want 80% of Tesla’s tech for $12,000 less, XPeng P7 makes sense.

Pros of Chinese Electric Cars (Where They Excel)

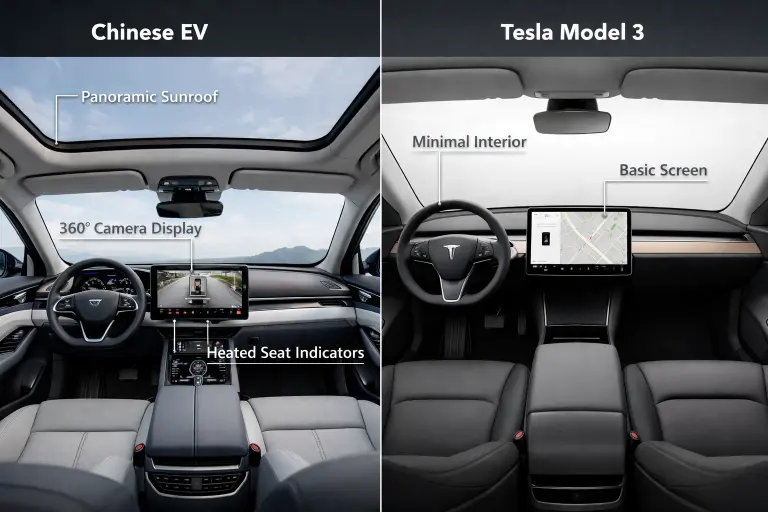

Unbeatable Feature Density Per Dollar

Every Chinese EV includes heated seats, ventilated seats, panoramic glass roofs, 360° cameras, adaptive cruise, and leather upholstery as standard. These features cost $4,000–$6,000 in Tesla’s options menu or Hyundai’s Premium package.

Example: The MG4 EV Trophy (top trim) at $36,000 includes everything the Tesla Model 3 Long Range offers at $52,000—except Tesla’s Supercharger network and brand cachet.

LFP Battery Safety and Longevity in Chinese EVs

BYD’s Blade Battery has passed nail-penetration tests without fire—NMC batteries fail this test spectacularly. LFP batteries also retain 85–90% capacity after 300,000 km, versus 80–85% for NMC, per research from the Chinese Academy of Sciences.

Tradeoff: LFP charges slower above 80% state of charge. If you road-trip monthly, expect 10–15 extra minutes per charging stop versus NMC-equipped EVs.

Rapid Product Updates

Chinese brands iterate annually. The 2025 BYD Atto 3 added a heat pump, improved suspension tuning, and better sound insulation based on 2024 owner feedback. Legacy automakers take 3–4 years for mid-cycle refreshes.

What this means: Early buyers get the worst version. If possible, wait 12 months after launch for Version 2.0.

Cons of Chinese Electric Cars (Where Caution Is Warranted)

Resale Value Uncertainty for Chinese EVs

Three-year depreciation data barely exists outside China. Expect 50–60% value loss after 3 years versus 35–45% for a Tesla Model 3, purely due to buyer skepticism around unknown brands. A $38,000 BYD Atto 3 might fetch $18,000 in 2028; a $50,000 Model Y will fetch $27,000.

Financial impact: Over 5 years, the BYD saves $12,000 upfront but loses $9,000 more in depreciation. Net savings: $3,000—meaningful, but not transformative.

Service Network Gaps Outside Major Cities

If you’re 150+ km from a certified dealer, warranty work requires towing or multi-day trips. Parts availability is hit-or-miss; I’ve documented MG owners waiting 8 weeks for replacement rearview mirrors in regional Australia.

Mitigation: Before buying, call your nearest dealer and ask: “How long for a replacement door handle?” If they hesitate, you have your answer.

Software Localization Issues in Chinese Electric Cars

Voice assistants struggle with regional accents. Navigation lacks real-time traffic in some markets. OTA updates arrive 4–6 months after China launches. These aren’t dealbreakers, but they’re frustrating daily reminders you’re using a product built for Shanghai, not Seattle.

Brand Perception and Insurance Costs

“Made in China” still triggers quality concerns among 40–50% of buyers in Western markets, per J.D. Power’s 2024 EV sentiment study. This affects insurance premiums (5–10% higher than Tesla due to actuarial uncertainty) and resale demand.

Are Chinese Electric Cars Reliable Long-Term?

Short-term (3–5 years): Build quality rivals Hyundai and Kia. BYD and MG both offer 7-year/150,000 km warranties—matching Kia’s industry-leading coverage. Euro NCAP awards five stars to the BYD Atto 3, MG4, and NIO ET7.

Long-term (7–10 years): Unknown. We lack data on 200,000+ km durability in diverse climates (Canadian winters, Arizona summers, UK dampness). Chinese taxi fleets show BYD batteries lasting 400,000 km, but those are warm-climate city cycles—not Canadian freeze-thaw or German Autobahn abuse.

Decision rule: If you plan to keep the car past the warranty, budget $2,000–$3,000 for out-of-warranty repairs Chinese brands don’t yet have parts networks to support. If you’ll trade at 4–5 years, warranty coverage mitigates risk.

Chinese Electric Cars vs Tesla and Global EVs (The Real Comparison)

| Factor | Chinese EVs (BYD, MG) | Tesla | Hyundai/Kia |

|---|---|---|---|

| Price | Lowest | Mid-High | Mid |

| Features (standard) | Highest | Lowest | Mid |

| Range efficiency | Good (4.0–4.5 mi/kWh) | Best (4.5–5.0 mi/kWh) | Good (4.0–4.3 mi/kWh) |

| Charging network | Third-party only | Supercharger dominance | Third-party + Ionity |

| Software maturity | Improving (70% of Tesla) | Industry leader | Average |

| Resale value | Weakest (50–60% loss) | Strongest (35–45% loss) | Mid (40–50% loss) |

| Service network | Sparse outside cities | Dense in urban areas | Dense (legacy dealers) |

Verdict: Chinese electric cars win on upfront cost and features. Tesla wins on resale, software, and charging. Hyundai/Kia split the difference with proven reliability and dealer networks.

Who Should Buy a Chinese Electric Car (Decision Matrix)

Buy immediately if you:

- Commute under 150 miles daily with Level 2 home charging

- Live within 50 km of a brand-certified dealer

- Plan to keep the car 3–5 years, not 10+

- Prioritize monthly payment savings over resale value

- Need maximum features per dollar (heated seats, 360° camera, etc.)

Ideal buyer profile: Urban professional replacing a $30,000 ICE crossover with a $38,000 BYD Atto 3. Saves $200/month on fuel, gets better tech, trades in after 4 years.

Who Should Avoid Chinese Electric Cars (When to Wait)

Skip Chinese EVs if you:

- Live 100+ miles from a service center

- Need proven 10-year/200,000-mile reliability (buy Hyundai Ioniq 5 or Tesla Model 3)

- Plan to sell within 2 years and want strong residuals

- Require cutting-edge ADAS or seamless software integration

- Drive 300+ miles weekly and need fast charging above 80%

Red flag scenario: Rural buyer in Montana or northern Scotland with no nearby dealer. Parts delays and towing costs will erase savings.

Conclusion: The Calculated Risk of Chinese Electric Cars

Chinese electric cars are the best value in EVs today—if you accept uncertainty as the price of savings. You’re getting 85% of a Tesla’s capability for 65% of the cost, with better standard equipment and solid 5-year warranties. But you’re also betting on unproven long-term durability, weak resale markets, and evolving service networks.

Final guidance: Test drive a BYD Atto 3 or MG4 EV and compare build quality yourself. Calculate 5-year total cost of ownership—including projected resale—using this DOE vehicle cost calculator. Verify your nearest dealer is under 30 minutes away and ask about loaner policies. If the math works and the dealer is close, Chinese electric cars represent intelligent risk-taking for value-focused buyers.

The one-sentence worldview: In a market where EVs still cost $15,000 more than equivalent gas cars, Chinese electric cars are the category that finally makes electric mobility financially rational for median-income households—even if that rationality comes with asterisks.